Anil Malhotra, CMO at Bango, looks at how UK streamers could learn from the US

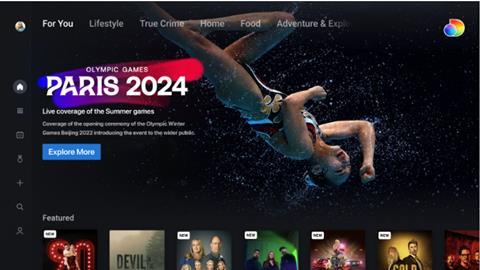

From the Euros, to the Paris Olympics, to the Super Bowl, 2024 has been a huge year for sports.

These iconic moments didn’t just draw in millions of fans—they also pushed sports streaming platforms to their limits, forcing them to rethink how they handle spikes in viewership and deliver top-quality experiences. Now, as the year wraps up, it’s a good time to step back and see what worked, what didn’t, and what the streaming industry can learn from 2024 about the future of sports streaming, and how today’s sports fans interact with their favourite subscriptions.

Subscriber surge: the Super Bowl effect

The “Super Bowl effect” is a perfect example of how powerful big sports events can be for streaming platforms. Paramount+ gained 3.7 million subscribers in just the first quarter, simply by having the exclusive rights to one of the most-watched games in the US. It shows just how valuable major events are for pulling in new viewers.

The same thing happened when the Olympics hit Peacock. According to Bango’s SportsVOD report, almost one in four viewers said they’d sign up for a new streaming service just to catch the games. That’s a huge opportunity for any platform that can lock down the rights to these kinds of events.

But here’s the tricky part: what happens when the big game is over? How do these platforms keep all those new subscribers once the excitement dies down?

Too many players on the pitch?

Despite the initial surge, maintaining subscriber growth remains a challenge. As ever more subscription and streaming services enter the market, sports fans are increasingly frustrated by fragmented content and high subscription costs.

Bango’s findings show that the average sports streaming subscriber in the US spends $1,440 (£1,111) annually on streaming services, compared to a general US average of $924 (£713). This disparity signals the premium sports fans are willing to pay, but also highlights a potential tipping point.

The UK sports streaming market mirrors these trends. Major platforms like Sky Sports and TNT Sports can push monthly expenses to over £75, leading to similar frustrations among UK fans who juggle multiple services. When consumers feel overwhelmed by fragmentation and high costs, satisfaction plummets, and the risk of churn increases.

What UK streamers can learn from the US

US sports streaming subscribers, on average, juggle seven separate subscriptions — two more than the average subscriber — reflecting the splintered nature of sports streaming rights. This has led 87% of US sports subscribers to express a desire for a single ‘content hub’ that can consolidate all their sports services into one easy-to-use platform.

The same pain points are starting to resonate in the UK. With the Euros and the Olympics drawing record viewers, UK fans have also faced subscription overload and confusion over where to watch their favourite teams. The popularity of traditional broadcasters like the BBC and ITV for major tournaments emphasises a key difference: unlike the US, the UK still relies heavily on free-to-air channels for high-profile events. But as more content shifts to digital, UK viewers may soon find themselves in the same fragmented ecosystem as their US counterparts.

From Super Bowl to Super Bundling

One solution gaining traction around the world is Super Bundling. Already making waves in the US and Australia, Super Bundling aims to consolidate various streaming services into a single, flexible offering — a central content hub with one monthly bill. Platforms like Verizon +play and Optus SubHub are already leading the charge by allowing Australian and American subscribers to mix and match services in one place, reducing complexity and cost.

For the UK, a similar approach could revolutionise the sports streaming landscape. In future, we could see a centralised platform that brings together Sky Sports, TNT Sports, ITV, DAZN, and Prime Video, offering fans one-click access to all their favourite sports content. This would not only simplify the viewing experience but could also introduce more competitive pricing and flexible options, such as pay-per-view or short-term passes for major events. To do that however, some of the UK’s broadband providers would need to step up and provide their own Verizon +play style services.

Addressing the piracy challenge

Another insight from the US is the rise of piracy in response to fragmented services. Over half of US sports streaming subscribers report using illegal streams to access content that’s scattered across too many platforms. A unified, legal alternative could curb this trend by offering a more appealing option for fans who want convenience without resorting to piracy.

In the UK, this is a growing concern as well, particularly during big events like the Premier League, where multiple subscriptions are needed to watch all matches. A streamlined service could go a long way in reducing piracy and maintaining subscriber loyalty.

What’s Next for 2025?

The rapid evolution of sports streaming in 2024 has shown that viewers are willing to pay for high-quality content—if it’s easily accessible and reasonably priced. As we move into 2025, the UK sports streaming sector has a chance to learn from the successes and failures seen across the Atlantic. Developing all-in-one solutions, promoting partnerships among key players, and introducing flexible subscription models will be crucial steps forward.

The ultimate goal? To build a more cohesive, user-friendly sports streaming ecosystem that prioritises fan experience while ensuring sustainable growth. By adopting a Super Bundling approach and addressing the root causes of subscriber churn, UK sports streaming providers can make 2025 the year they turn fragmented frustration into a unified and compelling offering.

The final whistle

One thing is certain: the future of sports streaming will depend on collaboration and innovation. UK platforms, broadcasters, and telcos need to work together to build solutions that meet fan needs—whether that’s through centralised services, flexible pricing, or better content offerings. If they learn from the lessons of this year, and from their friends over the Atlantic, the UK sports streaming market can set the standard for delivering a truly exceptional sports streaming experience for fans everywhere.

Anil Malhotra is CMO at Bango

No comments yet