With production costs rising, distributors in our survey report are being asked to significantly increase funding to get programmes made, while also dealing with falling demand from buyers

With linear TV in decline, young audiences migrating to YouTube, SVoD platforms on the defensive and the global economy struggling to kick on, content funding is experiencing an economic reset that has wiped out many producers and left distributors grappling with several intractable issues.

“A fundamental change has happened. People still want great content, but it isn’t going back to the way it was, because that business model wasn’t sustainable,” says Banijay Rights chief executive Cathy Payne. “If it was, you wouldn’t have the number of platforms in the position they are in now.”

Enemy number one is production inflation, identified by our respondents as their top concern (43%). A particular problem in scripted, but also evident in non-scripted, is the high cost of energy, materials, food and talent. This is forcing distributors to take on greater risk in the form of larger deficits.

“Deficit financing used to be the alternative model, but now it feels like it’s the only way”

Paul Heaney, BossaNova

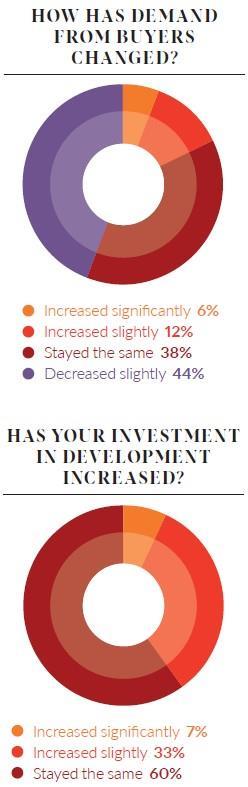

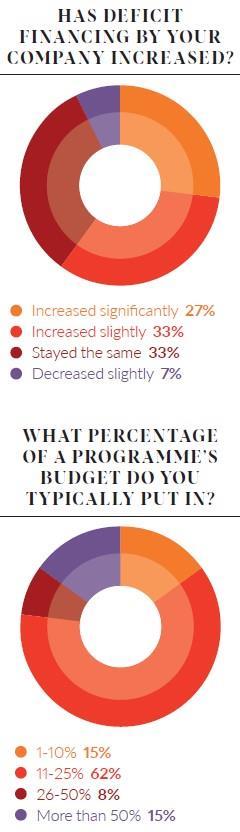

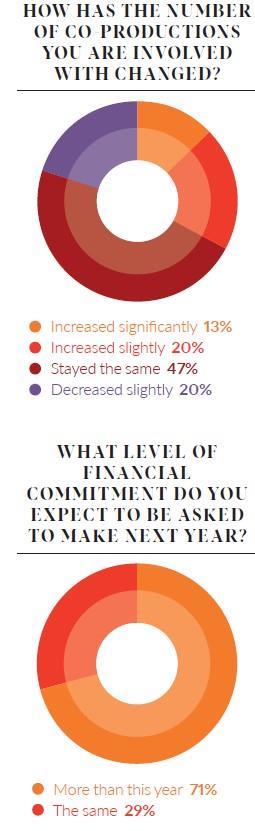

Some 60% of those surveyed say that deficits have increased, with a quarter saying they have jumped significantly. While the typical deficit is in the 11%-25% range, almost one in six say they typically put up more than 50%. And it’s not getting better any time soon: asked about the direction of travel for deficits, 71% say they expect to be asked for more next year.

BossaNova chief executive Paul Heaney speaks for most survey respondents when he says: “Deficit financing used to be the alternative model, but now it feels like it’s the only way. Any successful distributor will also be a deficit financer all the way through the lifecycle of a show.”

Increasingly, deficit demands are extremely onerous. One distributor says it is not unusual to be asked to put in £800,000 to £1.1m per episode on a high-end drama – circa 40% of the £2.5m budget.

Tim Mutimer, chief executive of Cineflix Rights, the largest independent in Broadcast’s survey, agrees there is pressure to stump up cash: “We have recently gone into a production on a scripted series where we exceeded our deficit thresholds for key cast breakage.”

Tough markets

The problem with taking on large deficits right now is that it coincides with a softer global acquisitions market. Some 44% of those surveyed say buyer demand has decreased in the past year, with 38% saying it has flattened.

Fremantle International chief operating officer Bob McCourt notes that the US market, traditionally the most important for UK distributors, is still “very tough, with too much content supply and not enough demand”.

Hat Trick International director of sales Sarah Tong says small-to-medium distributors are sharing the pain: “As budgets are squeezed, buyers are acquiring fewer new programmes and using more repeats.”

Bigger deficits and soft demand are just part of the problem. More than a third (36%) of distributors say it is getting tougher to secure content. While commissioning slowdowns have contributed heavily to this, market consolidation is also having an impact – as Tong notes, it is getting harder “to find content not affiliated with a big group”.

While the top seven distributors in our table represent 94% of total UK revenues (£1.74bn), up from 91% a year ago, 88% of that (£1.53bn) comes from just five huge integrated producer/distributors.

In some cases, scale is a major advantage. “We have such breadth and depth that no matter what the weather is, we can usually find a solution for our clients,” says ITV Studios managing director of global partnerships Ruth Berry. “We have big tentpole shows like Love Island and The Voice, which are well placed to secure any available budget.”

All of which is helpful in terms of catalogue or format-based revenue generation, but it doesn’t address the challenge of financing new content.

Payne says commissioning has become more selective. “Everything has to be more packaged, more developed, which means it takes longer to raise funds,” she adds. “We are seeing an increased number of UK titles struggle to complete financing.”

Fifth Season TV distribution president Prentiss Fraser says slow decision-making creates an additional issue for the sector’s leadership. “It makes the business less interesting,” she says. “A real challenge for those managing teams is, ‘How do you keep the fun in all of this?’ Risk aversion among buyers means you might not get your offer for a year.”

Appropriately, buyers’ selectivity coincides with a shift in the market towards the ‘acquimission’ model. Put simply, this means that instead of outright commissions, broadcasters are putting up a small share of the overall budget and expecting producers and distributors to find ways to complete their show’s financing.

While deficits are undoubtedly a concern, it’s notable that some distributors welcome the chance to become more involved in development. Mutimer says: “There is a real opportunity to work with acquisitions teams in key territories such as the UK, US, Australia and Germany. The ‘acquimission’ model represents a big opportunity for distributors and producers frustrated by the commissioning slowdown of originals.”

Head of TVF International Poppy McAlister echoes this: “Distributors have to invest more and take a gamble. But this can also be an opportunity. If TVFI comes on board at an early stage, we can help producers finance and provide editorial direction to shape projects to be truly international.”

The most obvious way to deal with this is to bring in additional financial partners to share the burden, with 33% of respondents saying they are engaged in more co-productions this year than last.

Not only do co-pros present the opportunity of pulling in buying partners, but they can also unlock soft money such as tax breaks.

In drama, Berry says: “We’ve got a number of people wanting to do co-productions. For example, there are still buyers who desperately want British period drama. We had a great example last year with Tom Jones [ITV Studios, Mammoth Screen, PBS Masterpiece]. We moved [senior vice-president of scripted] Jemma Harvey into an expanded co-production role to cater for this demand.”

Mutimer says cutbacks at the streamers are also fuelling the co-pro market: “With fewer global commissions, co-pro is being used more often as a way to greenlight high-end drama.”

It’s a similar story in non-scripted, with 92% of those surveyed saying they have pursued factual co-pros. McAlister says TVFI’s “production partnerships in Asia have opened up so many doors for us over the past year. Our co-pros have increased fourfold. We’ve sourced series from Japan, Korea, China and Singapore.”

But the co-pro environment is not without challenges too. A fifth of this year’s respondents report a decrease in co-pros, while 47% say they are the same. “Co-pros are still out there for sure, and we do a lot. But the time people spend talking about them probably doesn’t equal the amount they’re doing,” explains Fraser.

All3Media International chief executive Louise Pedersen says her company is doing fewer co-pros, and she believes UK broadcasters could do more to help. “Sometimes it comes down to simple things. For example, co-production partners typically want some certainty about transmission dates so they can plan their promotional campaign. But getting that basic information from UK broadcasters is very hard for us.”

In an era of high deficits, Pedersen calls on UK broadcasters to help relieve the pressure on distributors in areas such as rights flexibility. “Since Netflix introduced its ad tier, UK broadcasters have been much more reluctant to release secondary rights to shows early,” she says.

“But that UK secondary market is very valuable to us in terms of our business projections.”

Pedersen says this isn’t a big ask, noting that many other countries have already gone down this road. In fact, she says, flexible windowing and non-exclusivity could have a positive impact – by boosting exposure for programme brands.

The All3MI chief is not alone in this suggestion. Abacus Media Rights boss Jonathan Ford says: “Netflix puts most of its budget into originals, but it does have money for local second window rights as a way of creating a connection with domestic audiences.

“The UK broadcasters are generally reluctant to release these rights, although we have had success brokering a partnership between Netflix and Channel 5.”

Cost evaluation

The deficit discussion isn’t all about rights and co-productions, however. Fraser says the industry is at a watershed moment on costs.

“We’re starting to see people get serious about bringing down budgets. They’re asking, ‘Can we scale back the travel? Do we need that set build? Do we need that many extras? Where can we shoot cost-effectively?’ There are lots of people shooting in Spain now, for example. All of this is great, because it will be easier for distribution companies to deficit finance rest-of-world against one or two commissions instead of three or four.”

Of course, some UK broadcasters may give short shrift to the notion of giving up rights or ceding editorial control to secure funding. But this could mean distributors look to other territories for business. Fremantle and AMR have both enjoyed success with English-speaking shows from Canada and Australia, and Hat Trick International is also looking for content beyond the UK. Berry says ITVS has several UK scripted shows in the pipeline, but the majority of titles it took to this year’s LA Screenings were from elsewhere – the US, Australia and Europe.

In other words, it appears there is a risk that, if broadcasters refuse to cede ground on rights, UK content may lose ground to foreign competition.

BBC Studios chief executive of global distribution Rebecca Glashow is upbeat about UK output while acknowledging that “significant change and rationalisation” over the past couple of years has brought “an increased focus on content utility and cost-efficiency”.

She adds: “We have the privilege of working with the best producers in the rich and vibrant UK creative community, and with content that has been commissioned with a clear focus on audience value.”

Like most of the industry, issues facing distributors are often linked to strategic developments at SVoD majors. These streamers sparked the content arms race – and the same group has accelerated the current downturn with extensive cutbacks. Nevertheless, all of the survey’s large distributors are still doing business with Netflix, Disney+, Amazon and Warner Bros Discovery.

Payne says global market leader Netflix continues to spend aggressively on originals “and typically wants to control global rights”.

“They also acquire a lot of catalogue to meet their domestic needs, and will occasionally co-produce – for example, on BBC1 drama Lockerbie,” she says. “With the other platforms, like Amazon, you might see more flexibility with deals around a single territory or group of territories.”

McCourt sees Netflix’s biggest shift as its waning appetite for premium scripted. “The sort of high-end, platform-defining, auteur drama we saw three or four years ago isn’t being acquired any more. Netflix has gone mainstream in the past couple of years.”

While business with the streaming giants has cooled, 88% of distributors say they have secured deals with smaller regional SVoDs. In tandem, 75% of companies say BVoD-only sales to traditional broadcasters are “a meaningful part” of their strategy.

This is promising, though Woodcut International managing director Koulla Anastasi warns that switching from linear and BVoD deals to BVoD-only typically means a lower licence fee.

The continued growth of the FAST/AVoD ecosystem has created a zest for rights exploitation. At least half of our distributors have done deals with Pluto TV (67%), Roku TV, Tubi and Amazon Freevee. Rakuten, Xumo, Samsung TV Plus and broadcaster-backed platforms are also cited as customers.

Some 47% of survey respondents have set up their own FAST channels in the past year, with Fifth Season and Woodcut both planning to launch channels soon. The biggest companies are the most active. “Fremantle ended the year with 22 channels across 20 different platforms in 20 countries,” says McCourt. “Outside the US, we are seeing growth in markets like the UK, Germany and Australia.”

Glashow says: “FAST helps breathe new life into catalogue content. Given the extent of BBCS’s library, it’s an area where we have the flexibility to programme dedicated channels, dive into single IP and experiment with pop-up channels as relevant.”

If there’s a notable editorial trend, it is that companies are more focused on single IP/ personality-led channels than broad-based genre plays. ITVS cites River Monsters, Hell’s Kitchen and Graham Norton as key brands. Factual and formats are more of a priority than drama – as they provide high-volume series that can replenish channels more readily. The main exception is BBCS, which has prior experience as a global channel business, and can draw on major drama reserves.

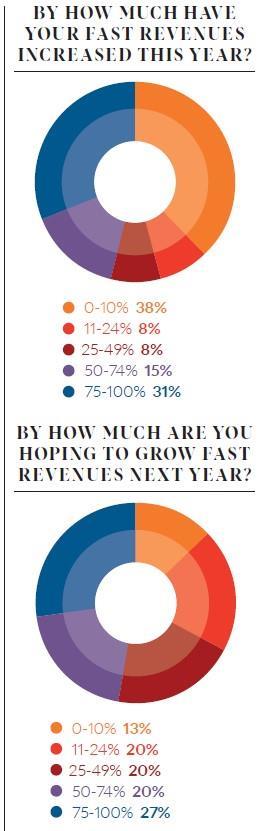

As for FAST revenues, our companies are bullish, with 31% having seen a rise of 75%-100% in the past year. Looking ahead, 47% expect to see a further 50%+ rise during the coming year.

Alongside BVoD and adjacent to FAST, YouTube is also now firmly on the radar for distributors. Berry says ITVS has doubled the size of its YouTubefocused team and now has around 140 ownedand- operated channels, the biggest of which is for The Voice.

McCourt takes a similar line: “We are moving towards putting full episodes on the platform, such as QI and Grand Designs. We resisted doing that in the past out of fear of cannibalising the audience, but we are seeing revenues come through.”

Switching attention to geographic trends, the US (61%) remains the key market for UK distributors, with Canada (22%) regarded as a valuable adjunct. Despite a reduction in the volume of trade, these North American powerhouses are the places where Brits currently conduct most business and aspire to expand into (63%).

Key territories

Australia remains a key market despite its leading media players being badly burned by a severe ad downturn. McCourt says the country appeals “in terms of format production, tape sales and acquisitions. It’s also one of the emerging FAST channel markets we are keeping a close eye on.”

In Europe, France and Germany remain popular, while some see Central & Eastern Europe as a growth opportunity. “It’s a region with a strong trajectory for both finished programming and format sales,” says Berry. “Ad revenues have been relatively stable, linear is robust, and our content is well suited to local tastes.”

Spain and Italy rate highly on the BBCS’s score card, says Glashow: “Both are markets of significance and value, where we have long-term relationships that we continue to nurture and build. In scripted, we have partners such as Telefonica, Filmin, Cosmo and Atresmedia in Spain. We’re delighted by the success of long-running series such as Death In Paradise and new hits like Blue Lights.”

LatAm is a focal point for several firms. “Cineflix has taken on a Miami-based LatAm sales consultant, Daniel Rodriguez, who is growing our business in the region, particularly through localising brands such as Property Brothers and Mayday: Air Disaster, and licensing them to free-to-air broadcasters. Our format Tempting Fortune was picked up for Mexico,” says Mutimer.

Having said all that, McCourt’s observation about the resurgence of mainstream drama has also coincided, he says, with a softening in interest in non-English-language scripted content, compared with a few years ago.

And with accessible, predominantly English-language scripted occupying audiences’ and buyers’ minds, the challenge for the UK distribution sector remains how it can help satisfy that demand.

It is far from easy. The companies that make up the Distributors Survey 2024 are full of expertise and resilience, and there are many examples of innovation and successful strategies.

But deficits are showing no sign of coming down and the feedback is that pressure on the sector is building steadily year after year. It feels as though the warnings it has issued are becoming amplified and the question now is whether producers, platforms, streamers and broadcasters are genuinely listening.

Distributors show resilience in tough times

Banijay Rights overhauls BBC Studios to top this year’s distributors table with strong growth despite difficult conditions for the industry

- 1

- 2

Currently

reading

Currently

reading

Distributors Survey 2024: Deficits grow as market softens

- 4

1 Readers' comment