Ampere Analysis found it has made a major difference to the market

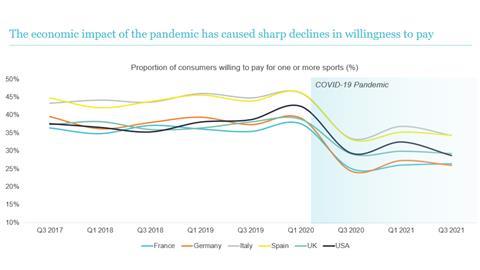

Research from Ampere Analysis has found that consumers’ willingness to pay for one or more sports has taken a large hit during the Covid-19 pandemic.

Speaking at the Broadcast Sport Content Summit on 30 September, Ampere Analysis’ Jack Genovese revealed that 38.9% of UK consumers would be willing to pay for one or more sports in Q1 of 2020, which dropped sharply to 29.3% in Q2 of the same year and is yet to recover.

The research comes from a regular survey of 14,000 respondents per wave, taken across France, Germany, Italy, Spain, UK, and USA. The UK results were mirrored across all of these markets.

Another survey, this time of 1,000 sport fans in the UK during Q1 of 2021, found that the competitions people are most willing to pay for are football related. The Premier League was top by some margin, with 37%, with the Champions League second with 17%. Wimbledon was the top non-football competition, with 10%.

Of those whose were willing to pay in the 1,000-person UK survey, the average amount they would want to part with was £21-per-month. This rose ot £24-per-month for consumers who engaged with sport content on social media daily.

In addition, these viewers watch 5.6 hours-per-week of live sports events, or six hours-per-week for those engaging on social media daily.

These figures are likely part of what has caused stagnation in the broadcast rights market. Serie A saw DAZN pick up its rights at a lower price than its previous deal, Amazon Prime Video did similar with Ligue 1, and the Premier League rolled over its deals at the same price as before over the last year.

Genovese explained: “As we approach the end of the period of sports rights inflation that has benefited the top European (predominantly) football competitions, athletes and clubs have already begun to look for other sources of revenue growth for the future, primarily through commercial and sponsorship partnerships. Social media can play a huge part in achieving that: Ampere Analysis’s research shows sports fans who are active on social media are more engaged: they watch more live content, they spend more, and they are more loyal.

“Clubs with a higher social media following tend to generate higher than their peers in commercial and sponsorship revenues, and even though the relationship is a little more nuanced than that, brands will always consider a clubs’ or athlete’s social media following when considering sponsorship opportunities.”

No comments yet