Streamer beats Wall Street Q2 forecasts to hit 278m subscribers

Netflix beat Wall Street revenue and other financial forecasts in the second quarter and blew past subscriber growth forecasts as it added 8.1m global paid members to reach 277.7m.

Revenue of $9.6bn climbed 16.8% year-on-year, beating Bloomberg consensus estimates and Netflix guidance of $9.53bn and $9.49bn, respectively.

Earnings per share of $4.88 increased 48% over Q2 2023, beating analysts’ forecasts of $4.74 and the company’s own guidance of $4.68.

Global membership was way ahead of the 4.7m estimate. The streamer announced in its Q1 earnings call back in April that starting next year it will stop reporting subscription numbers each quarter, save for milestones. That has prompted speculation that Netflix may foresee a slowing down in subscription growth.

The company reported on Thursday that operating margin reached 27%, operating income climbed 42% to reach $2.6bn, and free cash flow was $1.2bn.

Q3, full 2024 forecasts

For Q3 2024 Netflix has forecast revenue growth of 14% year-on-year and expects paid net additions to be lower than Q3 2023, which was the first full quarter to experience the impact of the company’s password sharing crackdown.

For the full year 2024, based on exchange rates at the end of Q2, Netflix expects revenue growth of 14% to 15%, up from 13% to 15% previously, reflecting “solid membership growth trends and business momentum”, partially offset by the strengthening of the US dollar against most currencies.

Executives also expect a 2024 operating margin of 26% based on exchange rates as of January 1 2024, up from the prior estimate of 25% due to “improved revenue outlook and ongoing expense discipline”. The goal is to grow operating margin each year.

Ads tier membership grew 34% quarter-on-quarter. Netflix said in its May upfronts that ad tier users had climbed to 40m, up from 15m reported in a blog post in November 2023.

Netflix is looking to grow average revenue per user (ARPU) on the ad tier above that of the ad-free tier. Last year the company raised its ad-free Basic and Premium tier subscription prices to $11.99 and $22.99 and did not change the $6.99 cost of the ad tier or Standard, which remained at $15.49.

The company said it is building an in-house ad tech platform that it will test in Canada this year and launch more broadly in 2025.

On the subject of partnerships, the company said in its letter to shareholders it does not see the value of bundling with other streamers ”because Netflix already operates as a go-to destination for entertainment thanks to the breadth and variety of our slate and superior product experience”.

Hit titles in Q2

In terms of hit titles, S.3 of Bridgerton led the way on 172m views, with multiple Emmy nominee Baby Reindeer on 88.4m views. The company also cited Queen Of Tears and The Great Indian Kapil Show, and popular films like French shark horror Under Paris (90m views), Jennifer Lopez sci-fi action film Atlas (79.3m) and Richard Linklater’s comedy Hit Man on 33.2m views.

India was Netflix’s number two and three country in Q2 in terms of paid net adds driven by the streamer’s biggest drama series ever Heeramandi: The Diamond Bazaar on 15m views.

Co-CEO Ted Sarandos touted Netflix’s 107 Emmy nominations this week led by titles like The Crown, Baby Reindeer, Ripley, and 3 Body Problem.

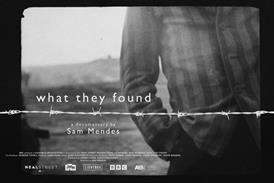

Looking ahead, Sarandos name-checked Jeremy Saulnier’s action thriller Rebel Ridge, Tyler Perry’s historical drama Six Triple Eight, and the Will Ferrell road trip documentary and Sundance acquisition Will & Harper.

Television highlights are expected to include Susanne Bier’s mystery miniseries Perfect Couple with Nicole Kidman and Liev Schreiber, Gabriel Garcia Marquez adaptation One Hundred Years Of Solitude, and new seasons of Squid Games and Emily In Paris.

“We have to spend the next billion dollars better than anyone else in the world,” Sarandos told analysts in the post-earnings call, “and there’s no-one better at doing that than Netflix.”

New interface

The company revealed it is building a new homepage that will offer users more information “at a glance” such as synopses and ratings. The navigation bar is being relocated to the top of the page, and the company is introducing ‘My Netflix’, a feature previously only available on mobile that shows every film and series a user has saved or watched. The company said the redesign is its biggest update in a decade.

The share price started the day at $655.7 and fell to $643.04 after the market closed due to revenue forecasts. Stock has increased 37.5% year to date. The all-time high was $691.69 on November 17, 2021.

Netflix is increasing its foothold in live sports and has two Christmas Day NFL American Football games starting in December and the delayed Mike Tyson-Jake Paul boxing match in November. The WWE Raw wrestling weekly live programming starts in 2025.

Executives said The Roast Of Tom Brady drew 22.6m views to rank as the highest live viewership ever on the platform. Upcoming live events include Joe Rogan: Burn The Boats and hotdog-eating contest Chestnut vs Kobayashi: Unfinished Beef.

“We’re in live because our members love it and it drives engagement… The good news is advertisers like it too,” Sarandos said.

He also cited this week’s The Gauge report from Nielsen which showed Netflix’s share of total TV viewership in the US in June reached 8.4%, second only to YouTube on 9.9%. He added there was a synergy between the two companies.

Asked about AI, Sarandos said it was early to say how the field would impact entertainment but he saw it as a tool to help storytellers do their work.

- This article first appeared on our sister publication Screen

No comments yet