Analysts at Broadcast’s parent company GlobalData deliver their verdict on Netflix’s 2024 performance

![]()

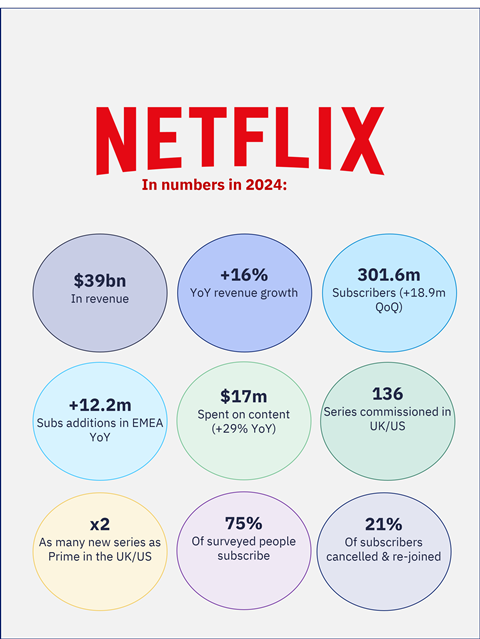

Yesterday (21 January), the global streaming leader presented its Q4’2024 earnings, reporting over $10bn (£8.1bn) in operating revenue for the quarter and a total of 301.6m subscribers. Drawing from GlobalData’s forthcoming Media Intelligence Centre, we dive deeper into the brand and its past year.

Key Financials

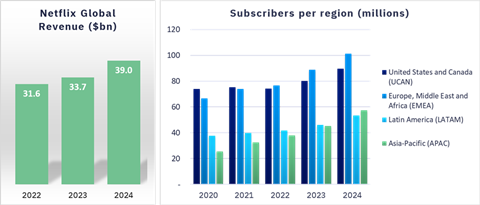

- · In 2024, Netflix brought home a total of $39bn in total revenues, a +16% increase from 2023.

- · It closed the last quarter of 2024 with $10.25bn (£8.3bn) in revenue, exceeding its projected forecast of $10.1bn (£8.2bn).

- · Yearly operating income rose to over $10bn for the first time in the streamer’s history.

Subscribers and regional growth

GlobalData had forecast that Netflix subscribers will reach 287 million in 2024 in the key 50 markets tracked, and the streamer outperformed this prediction by 14 million, totalling over 301 million subscribers, thanks to a record addition of 19m in Q4.

Following a positive 2023 where Netflix recorded a +9% year-on-year growth in subscribers, largely driven by the introduction of their ad-tier, the streamers saw subscriber growth slow quarter-on-quarter throughout last year. However, Netflix ended the year on a high note and bounced back, recording a 6% quarter-on-quarter growth and a 16% rise from 2023 levels.

The emergence or consolidation of new or existing players presented a challenge for Netflix, resulting in the leader losing some market share. Across the 50 markets tracked, GlobalData estimates the streamer commands 34% of the SVoD market, down from 43% back in 2020, and forecast it to decline further at CAGR of -1.3% by 2028.

Despite this expected scenario, given the crowded market, Netflix is showing signs of responding healthily to competitive pressures as its CAGR decline has plateaued compared with the last four years. Netflix’s ad-supported offering is an appealing alternative for many, with Q4 ad plans accounting for 55% of sign-ups across the countries in which the option is offered, a 30% growth quarter-on-quarter.

The streaming giant has invested heavily in EMEA, adding 12.2m subscribers in the region over the last year and overtaking those recorded in the US and Canada since 2023.

Given the maturity of Netflix in Western and Central European markets, most of the recent growth was driven by Middle East and Africa: according to GlobalData’s Consumer Survey*, 88% of people across the Middle East and Africa subscribe to Netflix, highest than any other region.

In addition, MENA’s growth rate from 2020-2024 was double that of Europe. Aside from a European push, Netflix is more recently focusing on growing in APAC, having a predicted CAGR of 10.9% in the next 4 years, higher than any other region. We can expect to see more Netflix content originating from Asian markets as a strategy to expand further in the region.

Content highlights

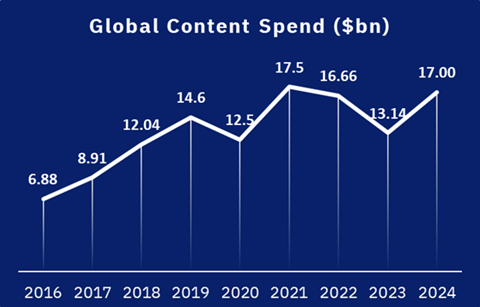

Content is clearly the core of the business and Netflix is committing to continued investment in light of positive earnings: FY2024, Netflix spent $17bn, a significant +29% increase from the previous year.

Netflix received 107 nominations and 24 wins at the Primetime Emmys from Ripley to The Crown and Beckham to Baby Reindeer. Recently, musical comedy-crime film Emilia Perez was rewarded at the Golden Globes. Returning series were a hit for the platform, with Squid Game 2 on track to become one of the most watched original series.

In 2024 Netflix began experimenting with live events, starting off big: the Mike Tyson vs Jake Paul boxing match in November peaked at 65 million concurrent streams. The streamer also delivered the NFL games on Christmas Day, and both events produced stellar outcomes for the platform.

This signals the beginning of a new era for the streamer as it equips itself to integrate more live events and sports in 2025 and beyond, starting with the $5bn (£4bn) deal for WWE Raw as well as the acquisition of the US rights for Women’s World Cup for 2027 and 2031, from FIFA. The media giant says its goal is to deliver “big, special event live programming” rather than simply acquiring large rights packaged to regular season sports.

Also in the live pipeline for 2025 are the SAG Awards and John Mulaney’s talk show.

| Content Highlights | Views (millions) |

|---|---|

|

Squid Game S2 (South Korea) |

165.7 |

|

The Perfect couple |

65.2 |

|

Monsters: The Lyle and Erik Menendez Story |

54.6 |

|

The Accident (Mexico) |

37.2 |

|

Nobody Wants This |

37 |

|

Outer Banks S4 |

36.8 |

|

The Lincoln Lawyer |

33.9 |

|

Virgin River S6 |

27.5 |

|

The Cage (France) |

24.4 |

|

The Menendez Brothers |

24.2 |

|

The Diplomat S2 |

21.4 |

|

The Empress S2 (Germany) |

21 |

|

Desperate Lies (Brazil) |

19.5 |

|

Simone Biles: Rising |

19 |

|

Breathless (Spain) |

17.3 |

|

Senna (Brazil) |

16.2 |

|

Culinary Class Wars (Korea) |

11 |

|

Tokyo Swindlers (Japan) |

10.5 |

According to our Broadcast Intelligence Programme Index tool, Netflix commissioned 136 titles across both the UK and US in 2024, an increase in volume from 2023. US commissions made up 50% of the slate, a further 36% of programmes came from the UK and 14% were produced across both markets. Drama dominated in the US, but the UK greenlit more factual, (44% of all UK commissions). The premium drama demand in the US was mirrored by high-end non-scripted orders in the UK.

Crime continued to dominate as a genre across both scripted and non-scripted programming. Another key sub-genre was sports-focussed series: UK indie Box to Box Films was a leading supplier, producing five sports documentaries including Drive to Survive S7 and Six Nations: Full Contact S2.

Compared to other global streamers tracked by Broadcast Intelligence, Netflix stood out once again as the leading commissioner, by a large margin. In the UK and US, it commissioned almost twice as much as closest competitor Amazon Prime.

What subscribers think

It is important to note that Netflix has indicated this will be the last earnings report in which it will publish its quarterly subscriber figures, with the streamer moving its focus to other metrics.

In October 2024, GlobalData surveyed more than 60,000 respondents across 30 global markets to uncover consumer insights into media consumption, subscription behaviour and content preferences.

The survey found that 75% of the people questioned subscribed to Netflix and that 72% are planning to either keep or add Netflix to their list of subscriptions in the next 6 months, highlighting the scale and popularity of the service.

Profiling Netflix subscribers, we notice they are the most likely group to have cancelled and re-joined a platform, with one in five subscribers claiming to have done so. In wanting to access different content from a variety of channels and distributors, we see consumers, especially younger demographics, being less loyal to single brands and instead finding creative ways to navigate the challenge of price and subscription stacking - such as switching subscriptions after watching exclusive content, sharing accounts and gravitating towards ad-supported tiers, digital and FAST channels.

Looking ahead

Netflix laid out some strategic priorities for its business in FY2025, including the growth of its content slate, enhancing product experience, scaling its ads business, developing new initiatives in the live programming and gaming space, and growing the business sustainably. As part of this plan, consumers in the US, Canada, Portugal and Argentina are expected to see price hikes in the new year.

For content, scheduled big hits include returning seasons of top-performing shows like Squid Game, Wednesday and Stranger Things, as well as introducing new international projects such as The Leopard from Italy, Apple Cider Vinegar from Australia and El Refugio Atomico from Spain.

*In October 2024, GlobalData surveyed over 60,000 respondents across 30 global markets to uncover consumer insights into media consumption, subscription behaviour and content preferences.

This analysis is an example of the type of content that will be created by GlobalData’s forthcoming Media Intelligence Centre, which gives access to the industry’s data, analytics, and insights. Stay informed by joining our mailing list.

No comments yet