Healthy subs additions and uptick in spending point to strong performance

![]()

Analysts at Broadcast’s parent company GlobalData have delivered their verdict on Netflix’s Q2 performance

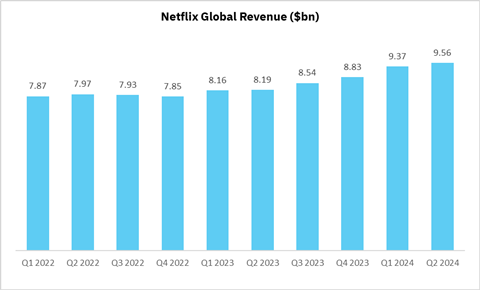

Netflix reported total revenues close to $10bn for Q2 2024, a 17% increase from the same quarter of 2023. This is slightly exceeding the 16% increase that was the company’s target expressed in its Q1 report. At the beginning of the year, Netflix forecasted 13-15% annual revenue growth for 2024 compared to the year prior; and so far, comparing H1 of both years, the media giant is reporting 16% increases, making this planned trajectory very likely.

The company continues to focus on driving revenue growth and increasing its operating margin, which was recorded as 27.2% for Q2 (ahead of the forecasted 26.6%). To achieve this it has taken measures such as increasing subscription costs, scaling its ad-supported business, and cracking down on password sharing.

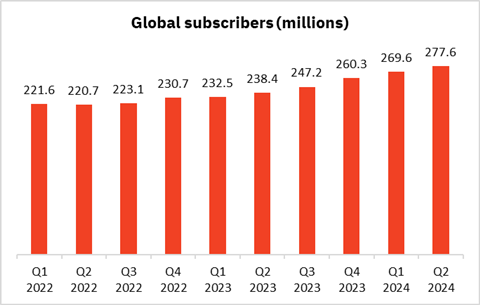

Global subscribers increase to 277.6m, driven by rapid growth particularly in EMEA and APAC. Ads tier memberships grow 34% quarter-on-quarter

Total subscriber numbers have gone up to 277.6m, a net addition of 8M over the last quarter. In comparison, in Q1 it had added 9M, and in Q4 ’23 had added 13m. However, Netflix had predicted a smaller net membership addition than in Q1 2024, a trend due to ‘typical seasonality’.

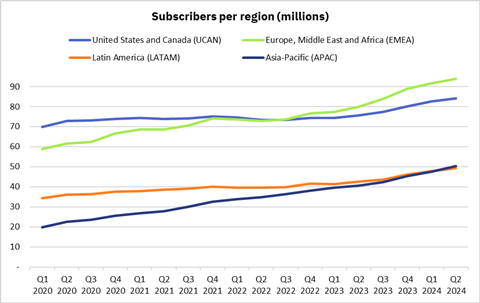

In Q3 2022, Europe, Middle East and Africa (EMEA) overtook United States and Canada (UCAN) to become the region with the highest number of subscribers and now contributes just over one third (34%) of global paid memberships, compared with 30% of paid memberships coming from UCAN. Despite this, due to pricing and membership tiers, UCAN still generates a higher revenue, and was responsible for 44% of global annual revenue in 2023.

GlobalData forecasts indicate that the US and Canada will grow its subscriber base to 90.7 million by 2028, though, given the rapid growth this region has been experiencing, this could be accelerated. We predict APAC and EMEA will focus regions for the streamer as they have both grown at a CAGR of 12% over 4 years (compared to 9% for US and Canada over the same time period).

Netflix is increasing its investment in local originals and partnerships with local studios in APAC, with Media Partners Asia reporting that the company plans to increase its yearly content spend in the region by 15%.

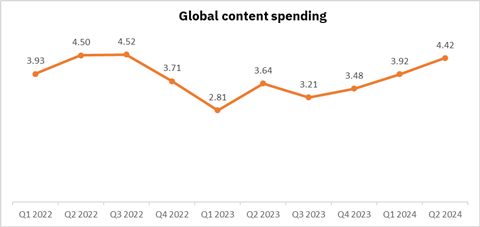

Content investment jumps after quiet end to 2023

Since a dip in Q1 2023, Netflix has picked up its content spend and has now reached $4.42bn this quarter. Its H1 content spend of $8.33bn means it is on track to reach its projected spend of $17bn for the year.

Netflix CFO Spencer Neumann emphasised in the Q2 earnings call that a large proportion of this spend will go towards original content which remains a strategic priority for the company.

Given these results, GlobalData predicts continued growth for Netflix and increasing net subscriber additions, maintaining its place as the leader in subscription streaming services.

The company is in a healthy position to reach its revenue and content spending targets for the year, and we expect it to continue driving revenue growth by scaling its ad-supported business and exploring alternative revenue streams such as monetising social media and other online video platforms as the company reports in its shareholder letter this quarter.

There is likely to be an increased focus on markets outside North America, in particular APAC and EMEA, which have experienced a high CAGR and seems to offer a big growth potential.

No comments yet