With fewer comedies and more straight dramas, the genre takes its place at the top of this year’s Hot Picks submissions

Scripted programming might be going through a correction period but is still very much in evidence in the global marketplace – there were more drama and comedy submissions for this years’ Mipcom Hot Picks than factual titles.

UK and international scripted titles accounted for 67 (45%) of the 150 submissions, ahead of factual on 60 (40%). This represents a subtle but signifi cant shift since last year, when the proportions were 43% and 45% respectively.

The growth in scripted comes from international titles, which have leaped by almost a third to 53 (35%). This spike chimes with what numerous distributors have told Broadcast over the past 18 months: that the reduction of US programming following the 2023 creative strikes would begin to have an impact on broadcasters towards the end of 2024, spilling into the first quarter of 2025. The gap in the market, they say, can be filled by international productions.

Nine countries and 43 companies are included in our annual snapshot of the key titles being sold in Cannes. The resurgence of global distribution – after a period of content warehousing by studios to feed their global SVoD players – is clear from the number of US studios that have put forward shows.

There are six – Amazon MGM Studios Distribution, Disney, Lionsgate TV, NBC Universal Global TV Distribution, Paramount Global Content Distribution and Warner Bros Discovery – up from four in 2023.

The premium streamer originals on offer from these companies are indicative of the need for media companies to have diversified revenue streams, which means being open to selling tentpole directto- consumer shows.

Disney is selling Disney+ EMEA originals Rivals, based on a Jilly Cooper novel, and Italian true-crime piece This is Not Hollywood – Avetrana, plus Hulu political thriller Paradise. Lionsgate has Starz Roman epic Spartacus: House Of Ashur on its slate, and WBTV is selling big-ticket HBO DC mini-series The Penguin.

Among the shows selected by Broadcast as Hot Picks are MGM+ post-apocalyptic tentpole Earth Abides (Amazon MGM) and Lockerbie: A Search For Truth (NBC Universal) – the debut scripted co-commission from Sky and Peacock. The latter represents the first vertically integrated project from the Comcast siblings, spanning commissioning, production and distribution.

Safe bets

In a risk-averse landscape, a third of scripted shows, both UK and international (23 of 67), fall into the audience-friendly crime, detective/cop or police procedural genres, presenting safer bets for buyers and better opportunities for distributors to sell.

Notably, more than half of the series (52%) that come under this banner are based on IP – novels and existing scripted formats – or are true stories.

Iconic detectives or brands returning to the market include Banijay’s Bergerac reboot for UKTV, Federation Studios’ Sherlock & Daughter and Fifth Season’s latest Agatha Christie adaptation, Towards Zero (pictured top).

Thrillers are also well-represented among UK and international scripted, totalling just over a fifth of submitted titles (14 of 67).

Perhaps due to the influx of interest around the US presidential race, there are two premium political thrillers in the mix: Disney’s Hulu series Paradise, which stars Sterling K Brown as head of security for a former president; and Escapade Media’s TNT drama Debriefing The President, based on former CIA analyst John Nixon’s book, which stars Joel Kinnaman.

Other high-profile series launching in Cannes include Beta Film’s European historical epic Rise Of The Raven and a pair of titles from Fremantle: action thriller Costiera, for Amazon Prime Video Italy, and BBC1 character drama The Listeners, from Normal People indie Element Pictures.

Also at Mipcom is Newen Connect’s Cat’s Eyes for France’s TF1. Inspired by the cult Cat’s Eye manga comics, the live-action series follows the estranged Chamade sisters – Tam, Sylvia and Alexia – who reunite to steal back a lost work of art belonging to their father that went missing in a mysterious fire a decade ago. The show has already outperformed its illustrious TF1 sibling, HPI, in terms of pre-sales.

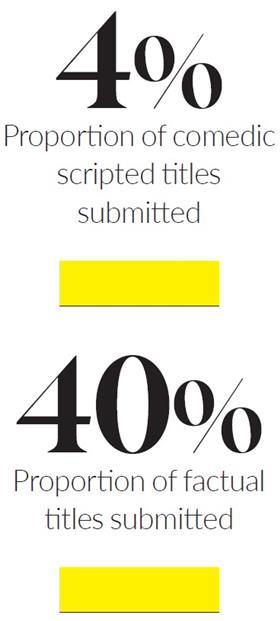

After last year’s predominance of scripted comedy and comedy drama, there has been a distinct shift to straight drama this year: comedic titles make up only 4% of submissions and 7.5% of international scripted (four of 53), down from a quarter (12 of 41) in 2023.

Boosted by a high-profile BBC acquisition, NBC’s workplace comedy St. Denis Medical is one of the better-known series heading to Mipcom, alongside BBC offerings Death Valley (BBC Studios), Smoggie Queens (Hat Trick International) and comedy drama Video Nasty (Boat Rocker Studios).

The proportion of factual titles in the overall Hot Picks submissions mix is slightly down, from 45% (55 out of 122) in 2023 to 40% (60 out of 150).

However, specialist factual titles continue to perform well: they represented 30% of the 62 factual shows submitted for Mip TV earlier this year, and the 16 titles being prioritised at Mipcom represent more than a quarter (27%) of distributors’ factual offerings. This is well clear of the next best-represented sub-genre: true crime (18%, or 11 out of 60).

There are nine history titles, six science-focused documentaries and one general title.

Specialist factual highlights include Nutopia’s potentially controversial docu-drama Jesus: Crown Of Thorns for Fox Nation (All3Media International); Untold Arctic Wars: The Cold War (TVF International), a companion to the distributor’s Arming The Arctic; and If Pigs Could Talk (Seven.One Studios International), an intriguing, AI-infused addition to the specialist factual pantheon.

One of Broadcast’s selections – Fremantle’s BBC2 series Mozart: Rise Of A Genius – signposts an increasingly common trend towards docu-drama. Producer 72 Films’ previous project was the well-received Shakespeare: Rise Of A Genius and the indie will hope its accessible exploration into the Austrian composer will have a similar impact.

Formats have also increased their share from last year, accounting for 15% of submissions – up from 12%. Almost half the shows have a competition element, underscoring that this is a key trend.

Indeed, Amazon MGM has had such a positive response to the BBC’s Gladiators reboot that it has made the format a priority in Cannes. Elsewhere, the latest show from format heavyweight Studio Lambert – The Anonymous for USA Network – is being distributed by All3MI, while fellow super-indie Banijay Entertainment is revamping 50-year-old dutch concept Crossing Land, Sea And Air.

An intriguing and atypical addition is history documentary format I Was Actually There, sold by Australian distributor ABC Commercial. The formats world is driven by entertainment and reality, but personal testimony and relatable subjects are proving crucial for factual buyers to connect with audiences, and this show looks like a standout title with strong global potential.

No comments yet