Banijay Rights overhauls BBC Studios to top this year’s distributors table with strong growth despite difficult conditions for the industry

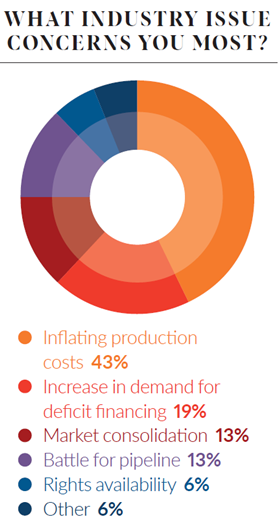

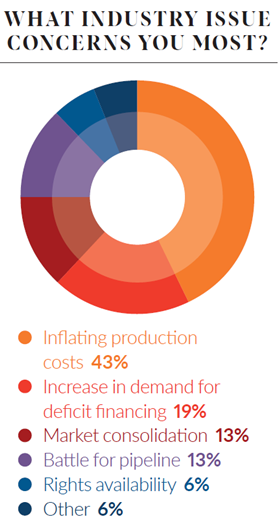

“Fewer buyers, harder-to-fund shows, more risk,” is how one leading executive sums up a challenging year for UK-based distributors.

“Increased production costs, higher deficits,” laments another. Yet for all the soul-searching among Broadcast Distributors Survey 2024 participants, this would still have been a growth year for the sector overall, were it not for a precipitous £140m drop in distribution revenues at industry flag-bearer BBC Studios.

This reversal in fortunes means that BBCS has been knocked off the top of the survey table for the first time ever, with both Banijay Rights and ITV Studios leapfrogging it. In tough times, it seems, having a humongous international catalogue and juggernaut formats like MasterChef and The Voice trumps all.

BBCS’s 28% drop to £361.5m doesn’t make for great reading, but it does make sense for several reasons. First, the company’s heavy dependence on UK-originated programming means it has been more exposed than its major rivals to the downturn in UK commissioning.

Second, it lacks Banijay Rights and ITV Studios’ strength in formats. And third, 2023 was an exceptional year for BBCS, with revenues topping half a billion – its best ever performance. BBCS chief executive of global distribution Rebecca Glashow acknowledges: “We benefited from multi-year deals that were recognised in fiscal 2023/24.”

| Rank | Company | Distribution turnover to April 2024 | Distribution turnover to April 2023 | % change | Value of International prog sales to April 2024 | Value of domestic prog sales to April 2024 | Top-selling programmes include | Hours of programmes in catalogue | Third-party producers % of catalogue | Non-UK % of catalogue |

|---|---|---|---|---|---|---|---|---|---|---|

| 1 | Banijay Rights | £389.1m | £359m | 8.4 | – | £55.3m | MasterChef; Home & Away; Survivor | 195,000 | 21 | 17 |

| 2 | ITV Studios | £368m | £342m | 7.6 | – | – | The Voice; Love Island; Vigil | 90,000+ | - | - |

| 3 | BBC Studios | £361.5m | £501m | -27.8 | – | – | Sister Boniface Mysteries; Planet Earth III; Blue Lights | 44,000 | 25 | 4 |

| 4 | Fremantle International | £236.4m | £229.6m | 2.96 | £157.8m | £47.1m | Sullivan’s Crossing; Alice & Jack; America’s Got Talent | 45,000+ | 20 | 70 |

| 5 | All3Media International | £178m | £201.9m | -11.8 | £151.9m | £26.1m | Boat Story; Champion; The Long Shadow | 35,000 | 50 | 11 |

| 6 | Fifth Season | £135.1m | £134m | 0.82 | £124.4m | £10.7m | The Night Manager; Life And Beth; Killing Eve | 1,335 | 87 | 46 |

| 7 | Cineflix Rights | £70.4m | £72m | -2.22 | £65m | £5.4m | Reginald The Vampire; Last King Of The Cross; Mayday: Air Disaster | 6,057 | 53 | 79 |

| 8 | Avalon Distribution | £27.3m | £19.1m | 42.9 | – | - | Taskmaster; Starstruck; Last Week Tonight With John Oliver | 3,500 | - | - |

| 9 | Abacus Media Rights | £20.1m | £20m | 0.5 | £17.5m | £2.6m | Scrublands; Pirates: Behind The Legends; The Frontier | 4,110 | 100 | 50 |

| 10 | TVF International | £15.9m | £15.6m | 1.92 | £15m | £0.9m | Down For Love; The Negotiators; Aerial Profiles | 4,700 | 99 | 68 |

| 11 | BossaNova | £11.6m | £7.5m | 54.7 | £8.6m | £3m | Borderforce USA: The Bridges; The Flight Attendant Murders; Caught On Dashcam | 1,281 | 100 | 80 |

| 12 | Passion Distribution | £11.1m | £12.1m | -8.26 | £9.1m | £2m | Kate & the King: A Special Relationship; Into The Congo With Ben Fogle; JFK: The Home Movie That Changed the World | 8,000 | 65 | 50 |

| 13 | Hat Trick International | £9.3m | £10.8m | -13.9 | £6.7m | £2.6m | Payback; George Clarke’s Amazing Spaces; Episodes | 2,700 | 40 | 18 |

| 14 | Orange Smarty | £4.5m | £4.7m | -4.26 | £4.2m | £0.3m | A Place In The Sun; The Titan Sub Disaster: Minute By Minute; Michael Palin In Nigeria | 2,000+ | 100 | 1 |

| 15 | Parade Media Group | £3.97m | £3.2m | 24.1 | £3.94m | £0.03m | Find My Country House USA; Country House Hunters Australia; Country House Hunters Canada | 3,500 | 98 | 90 |

| 16 | 3DD Entertainment | £2.08m | – | – | £1.38m | £0.7m | D-Day The Soldiers Story; Rock Legends; Murder Maps | 1,000+ | 0 | 0 |

| 17 | Raw Cut Distribution | £1.33m | – | – | £0.75m | £0.58m | Police Interceptors; Road Wars; The Detectives | 450 | 0 | 0 |

| 18 | Woodcut International | £0.7m | £1.08m | -35.2 | £0.7m | 0 | WW2 Women On The Frontline; Titanic In Colour; Surviving A Serial Killer | 218 | 6 | 3 |

BBCS’s decline has had a huge impact on the survey’s headline numbers, with this year’s cohort of 18 firms posting a cumulative turnover figure of £1.85bn, down 4.6% on 2023 (£1.94bn) but marginally ahead of the 2022 total (£1.81bn). Take away BBCS and a complicated picture remains, with seven other distributors posting lower revenues this year – a third of those surveyed – fulfilling last year’s warnings of leaner times in 2023/24. Of those that do report increases this year, only six have managed to beat UK inflation (7.3% in 2023).

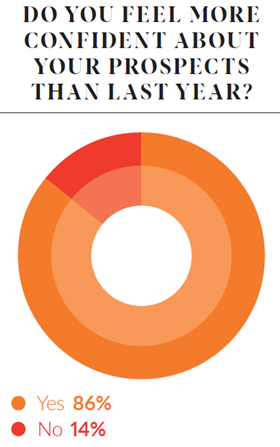

Eternally optimistic, 86% of survey respondents are confident that next year will be better. But a more useful gauge of the landscape is that only 46% say UK distribution has had a strong year economically. Last year, that figure was 63% (despite the shadow of the US creative strikes). In 2022, it was 90%.

Top-heavy sector

The distribution market continues to polarise, with the top seven distributors now accounting for 94% of all distribution revenues. This concentration of power is unlikely to reverse, since it would require a massive injection of capital into the survey’s mid-sized firms. Indeed, with 62% of our cohort expecting further consolidation, a more likely outcome is that the sector will become even more top heavy.

The leading super-indie groups continue to flex their M&A muscles, led by Banijay Entertainment’s absorption of the Beyond International catalogue, Fremantle’s acquisition of Asacha and ITV Studios’ consolidation of Hartswood Films, among other deals.

“We’ve done well in a challenging market, but a lot of that is attributable to our catalogue”

Cathy Payne, Banijay Rights

In unseating BBCS with £389.1m in revenues (up 8.4%), Banijay Rights chief executive Cathy Payne deserves congratulations. But she does not try to sugarcoat the volatile state of the market. A significant share of Banijay Rights’ increase in 2024 is down to a new accounting structure that has identified previously unreported revenues. In real terms, she says: “We saw a couple of percentage points increase. We’ve done well in a challenging market, but a lot of that is attributable to our catalogue.”

As anyone in the content creation business can attest, getting new shows financed is tough right now. “Funding scripted remains very challenging and requests for deficit financing are demanding,” Payne says. “At the same time, the pull-back of UK commissioning in the mid-price unscripted sphere has been heavily discussed, as has delayed commissioning from Channel 4.”

In straitened times for new shows, successful formats like MasterChef have been important for Banijay, with international versions proving increasingly lucrative. Formats have also been central to Banijay’s FAST (Free Ad-supported Streaming TV) strategy, with classic episodes of Deal Or No Deal, Fear Factor, Wipeout and Survivor used to create single IP channels, boosting alternative revenue streams.

ITV Studios has secured second place this year with a 7.6% increase in revenues to £368m. Like Banijay, the company has been able to exploit a vast catalogue (90,000+ hours) and lean into format juggernauts to weather the economic storm. Managing director of ITV Studios global partnerships Ruth Berry says: “The market has been risk-averse so established brands [Love Island; I’m A Celebrity; The Voice], affordable and engaging formats [Come Dine With Me] and high-volume gameshows [The Chase] have been the mainstay.”

Increased production costs and suppressed streamer demand have adversely affected the market, Berry notes, but she remains upbeat about the company’s ability to deliver fresh content: “Our buyers have been drawn to our new scripted slate by shows like Malpractice, Nolly and After The Party. We’ve also seen high demand for returning crime drama and thrillers such as Vera and Vigil. We launched natural history series A Year On Planet Earth from Plimsoll and are excited about the opportunities in high-end factual.”

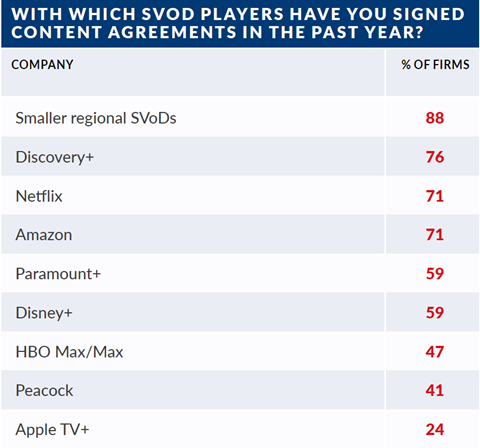

Berry points to AVoD/FAST as a bright spot, a sentiment shared by 47% of our distributors, who see the rapid expansion of this sector as the most significant business development of the year. She also says there has been resilience among traditional broadcasters, “with the growth of BVoD offsetting challenges around the impact on linear ad revenue”.

“We are seeing underlying growth for key content, which positions us well for the long term”

Rebecca Glashow, BBC Studios

Glashow says the issues affecting BBCS are also faced by the wider industry: “Production budgets remain at elevated levels. This can create challenges for distributors in financing and finding the right placements with broadcasters and platforms.”

The good news, she notes, is the market is stabilising: “We are seeing underlying growth for key content, which positions us well for the long term.

“We have listened to our partners around the world and that intel, along with our diverse slate, has helped us to focus on matching the right piece of content with the right buyer.”

In the current climate, BBCS can lean on the continued appeal of tentpole brands such as Bluey, Doctor Who and Planet Earth III, a co-production involving BBCS Natural History Unit, BBC America, ZDF and France TV. “The title launched across seven platforms in China concurrently, bringing huge reach and awareness for our natural history content,” says Glashow.

She also flags another ZDF co-pro – a modern take on Enid Blyton’s The Famous Five, with Nicolas Winding Refn steering. The show was pre-sold to TF1 in France and subsequently “sold to Hulu in the US and onwards internationally”.

Investment commitment

Glashow also sees strength in less-trumpeted titles in BBCS’s library, highlighting the breadth of content it can exploit. Cosy comedic crime returner Sister Boniface Mysteries and breakout gritty Northern Irish police drama Blue Lights are among its top-performing shows in the past 12 months.

Coming into 2024, she says, recent addition The Jetty is “BBC1’s top-performing new drama of the year to date. And A Good Girl’s Guide To Murder premiered on Netflix in 180 countries [outside of the UK].”

Glashow is aware that the turbulence that contributed to BBCS’s decline has not dissipated, but says this will not stop it from taking investment swings to find the next UK-originated hit: “We have backed a number of new scripted shows that exceed deficit thresholds but have strong strategic rationale and support from UK broadcasters.”

In fourth place in the table, Fremantle International has delivered a robust performance, with revenues up 3% to £236.4m. Chief operating officer Bob McCourt says the company is pleased, and perhaps surprised, to have slightly increased revenues in “one of our toughest-ever years”.

“We had some real export successes despite a number of key buyers cutting acquisition budgets or going away entirely,” he says.

McCourt says Fremantle’s catalogue has been an important shock absorber as library titles “account for 50% of our TV sales when it’s usually about 30%”.

Formats, again, are part of the story, but McCourt also points to soapy Canadian series Sullivan’s Crossing, which has proved a hit with buyers, with its positive themes “tapping into the current demand for mainstream, easy-to-market, high-volume, returnable series”.

Fremantle has also had its pipeline boosted through M&A deals, including its acquisition of Asacha Media Group, which owns eight European labels, such as the UK’s Red Planet Pictures, Arrow Media and Wag Entertainment. “These firms represent a mix of scripted and non-scripted,” says McCourt. “And in Red Planet, we have a fi rm that knows how to make mainstream drama.”

In fifth place, All3Media International has had similar difficulties to BBCS. Another distributor with a UK-heavy catalogue, it has followed a strong 2023 with a 12% decline to £178m this year. Top titles include BBC1’s Boat Story, Netflix’s Champion and ITV1’s The Long Shadow – three dramas from All3Media production labels Two Brothers and New Pictures.

All3Media International (All3MI) chief Louise Pedersen says the decline is “primarily due to the slowdown in the US market in terms of scripted co-productions and pre-buys. And I don’t see that situation changing just yet”. Unscripted format highflier The Traitors has helped, with 27 local adaptations so far, plus tape sales.

Another key development has been the acquisition of parent All3 by Jeff Zucker-led RedBird IMI for £1.2bn. It’s early days, but Pedersen says the new owner’s attitude towards growth is welcome. Pedersen says All3MI’s pipeline has been boosted by access to shows from companies recommended by RedBird IMI, including some true crime titles from Bright North Studios.

Matching its debut position of sixth last year, Fifth Season has grown its revenues by 1% to £135.1m. The distributor’s catalogue is dwarfed by its superindie peers, intentionally, as the company runs on the mantra of heavily curated, ‘best-in-class’ content. That said, Fifth Season has responded to the necessities of having choice in a capricious buyer landscape by growing its catalogue by 40% to 1,335 hours.

It is one of the three prongs to Fifth Season’s resilience, according to president of TV distribution Prentiss Fraser. The company has expanded its catalogue, with third-party content now accounting for 87% of its shows. Notable in this regard is a new representation deal with AVoD streamer Roku for its original programming.

Indeed, Fifth Season’s uptick in hours reflects wider activity among distributors. Some 72% of respondents report at least some augmentation of their catalogue, with 17% saying they have significantly grown their hours.

“We still place a lot of focus on being boutique, meaning we pay attention to the needs of every title,” says Fraser. “But by building our portfolio out into film, feature documentary, lifestyle & reality, digital-first and non-English-language content, we have been able to broaden our client base.”

Tapping into the past

Simultaneously, Fifth Season has increased its customer base by speaking to buyers “we wouldn’t have traditionally spoken to”, helping to maximise its business in a tricky year.

The company has also benefited from risk-averse buyers licensing proven shows, such as 2016 BBC1 thriller The Night Manager. “In the premium space, there’s definitely been a lot of buyers interested in renewals, dipping back into the things that worked in the past,” says Fraser. “That’s one advantage of working exclusively with best-in-category producers.”

Looking ahead, Fraser is optimistic about the company’s prospects – and points to the $225m (£171m) strategic investment from Japanese film and TV studio Toho International. “We’re starting to have strategic conversations with them, working on different deals together.”

In seventh place, Cineflix Rights has had a solid year, with revenues coming in at £70.4m. Although this is a 2% year-on-year drop, it follows a 26.8% increase from the previous survey.

Chief exec Tim Mutimer says: “Global headwinds and market consolidation have combined and led to buyers being more selective in their acquisitions strategy or working with frozen budgets. However, demand for our bigger, returning brands has remained strong. A+E’s acquisition of Property Virgins was a case of exploiting new seasons and the back catalogue.”

Cineflix is also bolstering its catalogue, with Mutimer earmarking a deal to acquire 200 hours of the Chateau DIY franchise from Spark Media Partners. Other deals delivering multiple hours include those with Go Button Media and Law&Crime Productions in North America, and Rock Oyster Media in the UK.

Mid-sized distributors are often perceived as vulnerable during periods of consolidation and economic gloom, but the 2024 survey’s mid-sized participants have proved resilient.

Avalon Distribution (eighth), which focuses on in-house titles like Taskmaster, reports a 43% rise to £27.3m. The company’s performance has been boosted in recent times by the success of comedy Starstruck, commissioned for a third series by BBC3 and US streamer Max, and a push into true crime, with series such as Murders At Little Bridge Farm.

Ninth place goes to Abacus Media Rights (AMR), where revenues have risen by less than 1% to £20.1m, aided by a broad mix of scripted and unscripted programming, including recently recommissioned Australian drama series Scrublands, which has gone to the BBC in the UK and Sundance Now in North America, plus doc series Pirates: Behind The Legends.

AMR, which was set up in partnership with Amcomri Entertainment, was recently acquired for £13.9m by Canadian company Sphere Media, which itself is backed by industry giant Bell Media.

AMR – which will now be called Sphere Abacus – knows Sphere well, having represented its titles, such as Max/CBC breakout dramedy Sort Of.

“We will operate as the international distribution arm alongside their standout production business,” explains Abacus managing director Jonathan Ford.

Pointing to growth opportunities, Ford says the deal will not alter AMR’s ability to work with myriad producers. “While we will look to maximise the potential of Sphere’s in-house titles, we will also continue to work with third-party producers,” he says. “In fact, we hope to have the resources to expand that side of our business.”

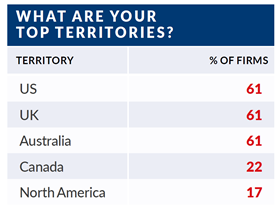

Ford is also buoyed by signs that the ad-supported market is coming back – though he notes: “The big US studios and platforms are still favouring their own content. For a firm like AMR, this has meant more local deals. It’s more important than ever to get in front of buyers, so sales trips and markets remain important.”

In 10th spot, factual specialist TVF International has also managed a small rise, up 2% to £15.9m. Head of TVFI Poppy McAlister says its independent status continues to appeal to factual producers wary of seeing their shows disappear into large catalogues. And while buyers have become more selective, there are “still slots on linear TV for core specialist factual genres such as history, wildlife, arts and science. Current affairs docs with unique access and a global outlook are also still in demand.”

Night Train Media-owned BossaNova’s revenues have leaped by 54.7% to £11.6m, taking it above Passion Distribution and Hat Trick International. Chief executive Paul Heaney says: “We’re present in the US and Germany, and are aiming to expand further and establish relationships in the Middle East and Central & Eastern Europe.”

Despite the positive year, Heaney laments: “There have been fewer commissions and the pre-sale market has been more challenging than we’ve experienced in years gone by. So while we’ve had some success with greenlighting projects from scratch, it’s not been plain sailing.

“Buyers are buying in a very forensic way, so our response has been to focus on returning series and big, noisy, one- to four-parters in areas such as access-driven, high volume and true crime.”

Revenues at survey stalwarts Passion Distribution (£11.1m) and Hat Trick International (£9.3m) have both dipped, by 8% and 14% respectively. The latter’s close connection with Line Of Duty scribe Jed Mercurio via parent Hat Trick’s joint venture HTM Mercurio ensures glossy, popular crime series such as ITV1’s Payback and DI Ray stand out in the catalogue. Director of sales Sarah Tong nods to the fact “there’s not only strong demand for great crime drama, but drama with strong female leads”.

Online demand

Scripted has been a priority for HTI in recent years and helps push up the total value of finished programme sales, says Tong. But HTI remains true to its non-scripted roots. George Clarke’s Amazing Spaces is a top seller, while “formats are an extremely important part of our business, with franchises such as Have I Got News For You and Rich House Poor House”.

Tong acknowledges that small- to medium-sized distributors are feeling the heat, with UK deficits continuing to increase. “UK broadcasters are relying more heavily on distributors to fund deficits, so we are looking to invest more in non-UK content.”

“The increasingly digital-first strategy being adopted by many channels means that the thirst for content is still very real”

Karen Young, Orange Smarty

Orange Smarty’s revenues are down just £200,000 (4.3%) to £4.5m. Chief exec Karen Young says pressure in the market has been off set to some extent by new buying patterns. “There has been higher demand from online platforms, particularly in FAST, and from broadcasters looking for content that sits across linear and online. The increasingly digital-first strategy being adopted by many channels means that the thirst for content is still very real.”

Young notes that Orange Smarty has seen “increased demand for lifestyle, celebrity/reality and social experiment formats. Buyers are looking for returning franchises, noisy one-off s and content that delivers not only in vision but also editorially and on social media.”

Parade Media, in 15th place, is one of only three distributors to enjoy a double-digit revenue bounce, up 24% to £3.97m. Chief executive Matthew Ashcroft says: “There is a budget reduction for finished and original production. However, Parade is seeing demand for its cost-effective, high production value, original programming”, adding that property, food and travel content is much sought-after. Parade’s Country House Hunters franchise has proved especially strong, with the Canadian and Australian versions among its top three sellers.

Amid the challenges of piecing together financing for networks and streamers with “multiple partners to fund original productions”, Ashcroft sees opportunities in broadcaster-led VoD.

“BVoD partners have reach, which makes content discoverable,” he says. “They report [viewing data] and have production quality thresholds, which means content can be monetised – in some cases significantly.”

The table is rounded out by three companies with distribution arms: 3DD Entertainment (£2.08m), newcomer Raw Cut Distribution (£1.33m) and Woodcut International (£700,000).

Woodcut International’s 35% dip from £1.08m looks pronounced but, as part of a UK indie, managing director Koulla Anastasi says, the commissioning slowdown has disproportionately affected the fi rm’s pipeline.

However, this is a double-edged sword. “We are often the co-financier on productions,” she says. “As part of a production group, pre-sales are a significant part of our business – leveraging our relationships with buyers beyond straight acquisitions. That’s crucial in today’s climate.”

Distributors show resilience in tough times

- 1

Currently reading

Currently readingDistributors Survey 2024: Distributors show resilience in tough times

- 2

- 3

- 4

No comments yet