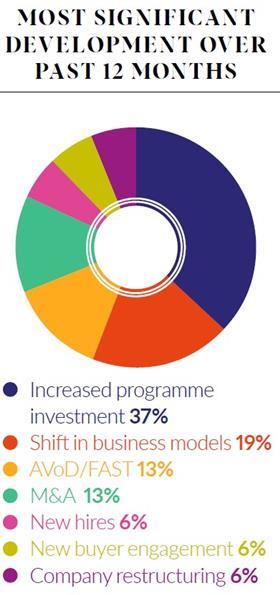

The Distributors Survey 2023 reveals that distributors are being asked to invest increasingly large sums up front as production costs soar and broadcasters and streamers tighten their belts

As audience demand for premium programming remains insatiable, while economic headwinds continue to blight the industry, the skyrocketing cost of content has become an increasingly onerous financial burden for UK distributors.

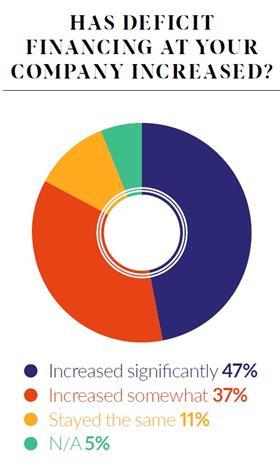

More than eight in 10 respondents (84%) report that demand for deficit financing has increased either “significantly” or “somewhat”.

“The expectation is high,” says one respondent. “Networks and streamers are looking at budgets and being more selective in the projects they back.”

“There is an expectation that distributors have become banks, which is not completely unfounded, albeit not in the literal sense,” quips another.

Hat Trick International sales director Sarah Tong has also observed a mismatch in expectations: “It is frustrating when commissioners demand a lot from producers but are not always prepared to pay for it,” she says. “That can leave the producer out of pocket and having to take investment from distributors, sometimes at unrealistic levels.”

Tong says the problem is particularly acute in drama – where deficits can be “massive, sometimes two thirds of the budget”.

“I realise commissioners are also in a difficult position, but it’s a concern,” she says.

Of the two respondents who say that deficit outlays have remained the same, one warns that “funding scripted series remains very challenging” and, with the ongoing market correction, where buyers are focusing on “profitability and quality over quantity, budgets need to reflect this new reality”.

“It is hard to see how distributors can continue to absorb the growth in drama production budgets”

Ruth Berry, ITV Studios

It might be assumed that this is a problem for less well-resourced distributors that don’t have the cash-flow to take on wider deficits, but major players are also worried, particularly in scripted.

ITV Studios managing director, global distribution, Ruth Berry notes: “Over the past five years, producers and commissioning broadcasters have looked to distributors to fund double-digit percentage growth in drama production budgets. Following years and years of increases, it is hard to see how distributors can continue to absorb this.”

Slowing demand

All3Media International chief executive Louise Pedersen strikes a similar tone. As distributors advise more caution about the wisdom of big deficits, she says: “We are not sure that broadcast commissioners, talent and production companies have fully appreciated the reality of the situation yet.”

The slowdown in demand from the US market and global SVoDs hasn’t helped, Pedersen says, as major media companies shift their focus from growth to profit: “We’re seeing situations where some shows aren’t getting financed because US uncertainty prevents distributors from being willing to plug the gap.”

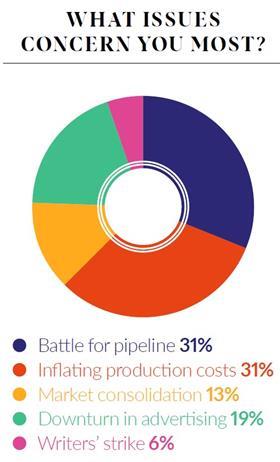

With distributors forced to dig deeper, other problems begin to spring up. Around a third of respondents (31%) cite programme inflation as the issue concerning them most, alongside the battle for pipeline (31%). Largely attributed to industry consolidation, with more programming remaining in-house, this scarcity has additional inflationary implications as companies compete for the best IP.

Fremantle chief operating officer of international Bob McCourt says the clamour among buyers for content that stands out adds further pressure. “The constant message from buyers is bigger, bolder, fewer – all of which comes with its own costs attached,” he says.

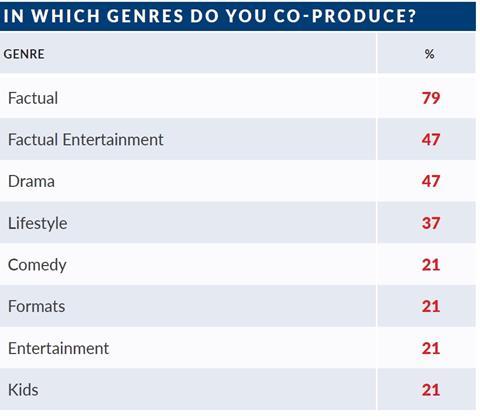

So how are distributors dealing with the challenge of greater deficits? Well, 74% of survey respondents say they have gone down the co-production or pre-sale routes.

McCourt says: “If you can get partners involved at an early stage, that mitigates risk. And if you can also work with the producers to access soft money, then you’re starting to get down to manageable deficits.”

While co-production implies a complex, multitiered relationship, most distributors are looking at more straightforward pre-sales as a pre-requisite for greenlighting a show. Abacus Media Rights chief exec Jonathan Ford says he will “look for a pre-sale as quickly as possible to manage risk. We have a strong network of buyer relationships so that’s something we can action with the right project.”

Tong agrees that pre-sales are a solution – but where budgets allow (usually in factual). Internal advances are sometimes preferable: “We don’t have the resources of BBC Studios or Banijay but if we have a really strong show, then sometimes we prefer to wait before taking it out to the market. That way you have more to show buyers. That might be enough to secure a higher fee – or to stimulate competition between rival broadcasters.”

Fifth Season president of TV distribution Prentiss Fraser also says companies “are a lot more open to partnering”.

“We’re going to announce a show soon where we brought three or four co-production partners together in a really short time,” he notes.

Orange Smarty chief exec Karen Young sees funding issues as a challenge rather than an insurmountable roadblock. “It is an opportunity for creative solutions,” she says. “This is our area of expertise, so we pride ourselves on our ability to unite the market with producer content, nurturing an idea by working collaboratively on the early-stage development of ideas.”

Orange Smarty invests more than a £1m a year in new content and has had co-financing success this year with series like Cursed Treasures, which was backed by two international partners, a UK broadcaster and top-up money from Young’s company. The series has sold into 49 countries and a second series is under discussion.

BossaNova chief exec Paul Heaney says there is more onus on producers to help out with putting financing together: “Good indies often have contacts that can make a world of difference when we’re trying to get a show into the US or UK,” he says. “With the size of deficits these days, it makes sense to pool our resources. Most producers see the logic of that, because they’re the ones who stand to get royalties.”

ITVS’s Berry also sees scope for collaboration in the windowing process, noting that some buyers from the same territory are increasingly open to “sharing windows” – almost unthinkable five years ago.

Accessing content has also become a little more challenging for distributors, with first-look deals becoming more nuanced. Cineflix’s Mutimer says: “Our first-look strategy is focused primarily on scripted content. On the factual side, while there are a number of producers with whom we regularly partner, we tend to we take a case-by-case approach rather than signing overall deals.”

Berry says changes in the market have affected ITVS’s approach to first-look deals: “When we were doing them five years ago, producers were generally developing a slate focused on traditional linear buyers. These days, they are developing more with global streamers in mind, and that makes it a bit more challenging for distributors because we will have some rights but not others.”

Digital growth

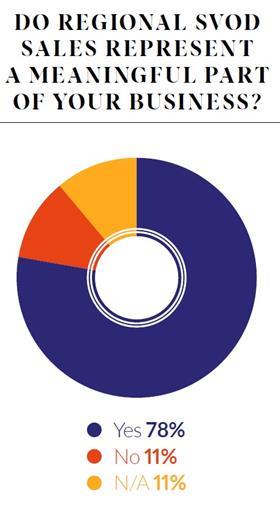

Distributors across the board highlight some positive gains in the digital arena, with SVoD services becoming increasingly flexible with their rights negotiations and the rampant growth of the FAST business creating an important alternative revenue stream for distributors.

On the former point, McCourt says platforms “used to insist on global rights, but they’re now more willing to go territory by territory. That helps with shows where you have already made a few sales.”

Banijay Rights chief executive Cathy Payne says: “It is a big positive trend that streamers are commissioning shows and only taking a licence in one territory, like the UK. So there’s no real difference to the situation where the BBC, ITV or Channel 4 pick up a show and we invest.”

Mutimer says the change has led to studios and global platforms being “more open to a deal-by-deal process, where we can negotiate less exclusivity, which means more windows”.

He adds: “For example, on the factual side, we are able to do a deal for a premier linear licence and then a secondary linear licence and/or FAST or AVoD.”

Fresh competition

If there is a catch, it is that streamers are also entering the distribution game, beginning to sell their original commissions to third-party buyers. This is best evidenced by the newly created Amazon MGM Studios Distribution, which has started licensing some of its legacy originals, including The Marvelous Mrs Maisel, Hunters and Goliath. This makes the market “more competitive”, according to Abacus’ Ford, because “programming previously held back for SVoD is now for sale”.

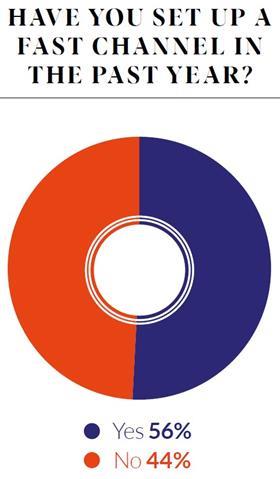

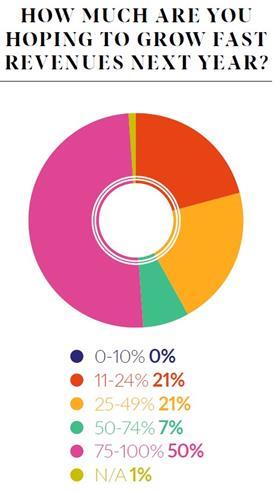

Some 36% of respondents say their FAST revenues have increased by more than 75% in the past year, with 50% saying they expect a similar increase in the next 12 months. Nine out of 10 say FAST will be important to their business in the medium term. The data suggests larger distributors, with extensive library titles and the resources and infrastructure to launch their own direct-to-consumer channels, are seeing the benefits more acutely than their peers.

Some 56% of respondents have launched FAST channels in the past year. The likes of BBCS, Banijay Rights, ITVS, Fremantle and All3MI all run single title or genre-based streams.

ITVS’s Berry says: “As with any new business, the value is small right now compared with our traditional B2B sales business. But it’s an opportunity to monetise long-tail content. With single-IP channels like Hell’s Kitchen, we’re finding there’s a huge community of 16 to 24 year-old guys learning to cook. The deeper message here is that FAST channels allow us to collect data and get closer to the audiences.”

Mutimer says: “Our catalogue offers long-running, high-profile brands with multiple episodes, such as Mayday: Air Disaster and American Pickers. We’re already seeing significant viewership of our North American FAST channels, and are planning to move our FAST business into other regions later this year.”

Passion Distribution managing director Nick Rees is wholeheartedly embracing the FAST world – recently launching a business called UpStream Media to focus “solely on the exploitation of AVoD and FAST rights”.

All3MI’s Pedersen also sings the praises of FAST, but adds that there is a shift in the market as it matures: “The platforms are becoming more selective as players like the US majors get involved,” she says. “Our portfolio has been resilient, but we’re seeing more situations where channels are being dropped if they don’t reach a high bar. More platforms are also starting to explore the possibility of exclusive deals, whereas FAST until now has tended to be non-exclusive.”

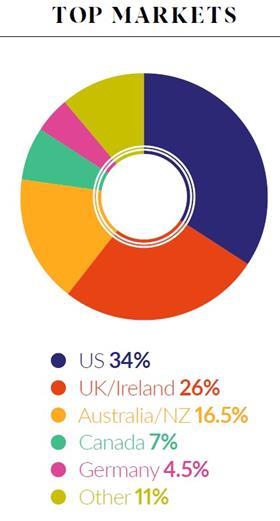

There is also an opportunity to sell content to third-party FAST channels but, right now, there are few that have the scale to be of interest to distributors, says BossaNova’s Heaney – even in the US, which is by far the biggest market.

Instead, the more lucrative opportunity is selling content to the AVoD platforms that carry the FAST channels. In this year’s survey, for example, around two-thirds of distributors have sold to Amazon Freevee, Pluto TV, Roku and Tubi. Freevee, in particular, has become increasingly significant since 2022.

“Regional and domestic VoD players are competing toe-to-toe with the likes of Netflix, Amazon and Disney+”

Matthew Ashcroft, Parade Media

The enthusiasm for ad-funded VoD platforms extends to regional buyers. Parade Media chief Matthew Ashcroft says: “Regional and domestic VoD players are competing toe-to-toe with the likes of Netflix, Amazon and Disney+, and often differentiating themselves through a local play combined with studio pipeline.” Platforms he cites include 7+ Australia, Jio India and Samsung TV Plus (now in several territories).

The appetite for local content is something that Banijay Rights’ Payne picks up on too. “These streamers will have a particular focus on local domestic product so having a substantial domestic catalogue is beneficial,” she says.

US cuts and consolidation

In terms of geographic trends, the US remains the key market – but there is a general view that it has been tougher to do business there in recent times. Asked to expand, one distributor laments “budget cuts in the US”, while another says: “The US market has been impacted by consolidation, with a significant slowdown in the first half of 2023.”

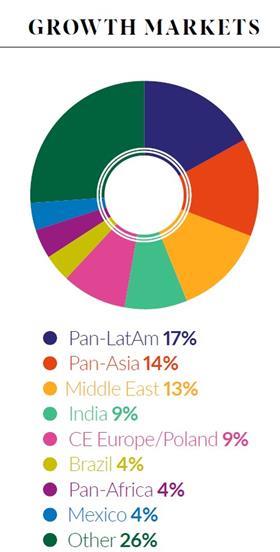

Elsewhere, LatAm is singled out as an emerging opportunity.

In genre terms, there’s a definite sense that English-language drama is a priority for UK distributors, though there is still huge interest in non-English scripted content.

Fifth Season’s Fraser says: “We tend to be quite opportunistic in this respect – focusing on the production rather than the language of origin. We’re launching titles from Greece and Italy, and have just signed a deal for a French title. If it’s a great story and the performances are amazing, we’ll be interested.”

Fremantle (My Brilliant Friend) and ITVS also continue to drive forward with their European scripted content. Berry says: “We’re working with our Italian studio Cattleya and recently launched the phenomenal Swedish success Blackwater (Apple Tree Productions). From France, Tetra’s Balthazar is now in season six.”

As for factual, Passion’s Rees says there is still strong demand for the popular factual and entertainment content in which the company specialises: “The brief for primetime formats is scale, drama and an aspirational tonal quality. We see demand for reality dating (with a huge twist), dramatic adventure/survival and psychological gameshow. Similarly, social experiments where those taking part are thrust into a once-in-a-lifetime experience and a unique setting are increasingly a priority.”

There is also appetite for “high-volume and returning adrenalised series featuring the emergency services and dangerous jobs,” he says. “True crime continues unbridled and seems to be polarising into high-end mini-series and returning crime-of-the-week formats.”

Despite the myriad challenges facing the sector, HTI’s Tong sums up why so many firms continue to be upbeat: “The bottom line is that there is always a home for good-quality content from UK distributors. If your idea is unique and original, it will sell internationally.”

Distributors make hay despite challenges ahead

- 1

- 2

Currently reading

Currently readingDistributors Survey 2023: Distributors express concern over gaps in funding

- 3

- 4

No comments yet