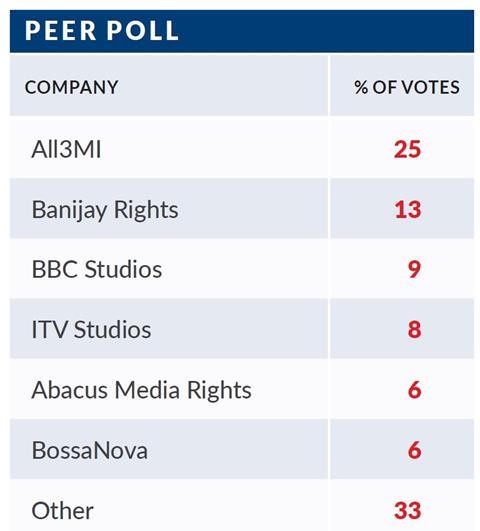

The Traitors outfit wins the backing of its peers for the sixth consecutive year, while Banijay achieves its highest ever position in second

As always, a wide array of distributors secured votes in the 2023 peer poll, including non-UK firms such as Off The Fence, Keshet International, Wildbrain, Sony and 9 Story. UK-based companies that narrowly missed out on a place in the table include HTI, Cineflix Rights, Passion and TVF International.

This year’s top six are…

1) All3Media International

25%

There’s no shifting All3Media International from the top of the annual Distributors Survey peer poll. Rated number one for the sixth year running by a quarter of this year’s respondents, one backer said All3MI has “a great distribution team, with a strong combination of creative and commercial content”.

Having smashed through the £200m revenues mark, chief executive Louise Pedersen says the company has benefited from a strong slate of UK scripted shows including The English, The Tourist and Trigger Point. But there is also competition format The Traitors, “which led the way in the new format sub-genre of intelligent reality”.

The popularity of the Dutch format has meant All3MI “has seen an uplift in ancillary revenues like licensing, merchandising, gaming and experiences”, Pedersen says. “That is certainly a growing area for us.”

She also singles out the “performance of our scripted formats in Asia (India, Malaysia and Indonesia), the success of our expansion into FAST channels and AVoD, and the growth of our premium factual business”.

“We’ve made a big push into that area since All3Media bought natural history specialist Silverback,” she says. “So I feel like we’ve really established ourselves as a leading player in that space.”

2) Banijay Rights

13%

Banijay Rights has achieved its highest ever position in the peer poll, with voters praising both chief executive Cathy Payne’s leadership and the strength in depth of her sales network. There is also a twinge of envy that Banijay has managed to hoover up so much premium non-scripted content through its aggressive acquisition strategy – with formats like MasterChef, Survivor, Big Brother, Deal Or No Deal, Lego Masters and Hunted all doing strong business globally.

While Payne lauds the impact of non-scripted on this year’s gangbusting revenue figures (up 12.9% to £358.9m), she stresses that scripted programming continues to be a key priority: “We have a good balance between the two, with the cash generated by nonscripted helping to fund bigger investments in drama.

Our recent scripted launches include Marie Antoinette, which has now sold into around 70 territories. At the same time, you really can’t underestimate the audience’s desire to revisit scripted classics like Broadchurch and Grantchester.”

Banijay has a strong internal pipeline of content, but Payne insists that third-party shows still have a place in the mix – they currently represent 13% of the total library. “We work with third parties all the time,” she says. “We’re totally agnostic on this point. We’re always upfront if we have something in development or in the library that could lead to a conflict. But there’s no restriction on who we would work with.”

3) BBC Studios

9%

BBC Studios is third this year, its highest position since 2020. That will be welcome news for chief executive of global distribution Rebecca Glashow, who took up her role in February 2022.

US-based Glashow’s appointment represented a shift in the centre of gravity for the BBC’s distribution division – and she says this has paid off.

“It has made it easier for our clients to do business with us. We have strengthened our commercial team, bringing in talent from US networks and platforms, and have greater alignment globally to unlock additional value and increase the reach of our content.”

Glashow doesn’t specify any shifts in the profile of the company’s 44,706-hour catalogue – preferring to highlight its strength across genres. “We have a deep library of content that appeals to a range of customer and audience needs. This is an incredibly strong position, which gives our sales teams flexibility in working with different platforms and networks around the world to customise solutions.”

Asked about key trends impacting the business, she says “a clear challenge is consolidation, which leaves fewer entities to work with”.

4) ITV Studios

8%

ITV Studios is fourth in this year’s peer poll, down from second in 2022. Aside from its impressive 14.8% growth in revenues, the big news has been a reorganisation of how ITVS sells its IP: “The growth of the streaming platforms, ongoing market consolidation and our clients’ adoption of a single buying approach across all genres has led us to consolidate our sales business,” says Ruth Berry, managing director, global distribution.

“Now we have one sales team organised regionally for our finished and format portfolio. This means we can align more closely with buyers.”

Aside from offering “a single point of contact”, Berry says it is now easier for ITVS “to support our labels, indies and brands”.

“We’re also excited about how our ancillary business can build out our non-formatted brands, and how our digital teams can build FAST/AVoD,” she adds.

While scripted and non-scripted have both been revenue drivers for ITVS, Berry points out that the company has also established itself as one of the world’s leading format producers and distributors: “Last year, we had 19 formats in three or more countries, which is prolific,” she says.

“The Voice alone is in more than 70 markets and has a strong YouTube presence. At a time when a lot of broadcasters are struggling with budgets, a key strength is the depth of our formats portfolio, both in genre and price points. We have everything from The Voice and Hell’s Kitchen to The Chase and The Alphabet Game.”

5) Abacus Media Rights

6%

Amcomri-owned Abacus Media Rights shares fifth place in this year’s peer poll with BossaNova. One distributor who voted for AMR called it “a young business that has already built a formidable and growing catalogue. Just look at the number of nominations for Abacus-represented shows at the Broadcast Digital Awards.”

Chief and founder Jonathan Ford says a key part of AMR’s USP is the personalised attention it can offer: “Every deal is an important deal for us, which is why we have established a good track record in terms of the ROI we generate on the content we represent,” he says. “But we are also fast-moving and flexible – with a network of buyer contacts that enables us to secure pre-sales on shows relatively quickly.”

As things stand, AMR’s 5,000-hour portfolio is split 50-50 between UK and international content, with a 100% focus on third-party shows. Looking ahead, Ford is keen to avoid the company overheating.

“It’s a tough market – so the current period has to be about cautious, incremental growth,” he says. “There are opportunities to grow, but we also have a job to do making sure we maximise the value of our library across both legacy platforms and emerging opportunities such as FAST.”

6) Bossa Nova

6%

Backed by German company Night Train Media (which also owns Eccho Rights), fast-growing BossaNova has made it into the peer poll top six for the second year running.

Key to the distributor’s strategy, says chief exec and founder Paul Heaney, has been investing in a mix of strong returning franchises and a few “short run, noisy, eye-catching shows that can capture buyers’ attention at markets. An example is The Flight Attendant Murders, which we’re launching at Mipcom.”

He stresses, however, that he is not interested in ticking every non-scripted box: “I used to think it was nice to have something in true crime, food, travel, history and so on. But I’m no longer convinced of the benefits of stretching the catalogue out in that way. The international market is very tough, which means distributors have to be very focused on curating their portfolio. I’ve pitched some amazing shows and just had to watch as buyers shake their heads.”

One way BossaNova tests the temperature of the market is via its growing development day (this year in October), where it brings producers and buyers together to forge creative and commercial alliances. This year, that led to a co-financing partnership with Channel 4 on Ancient Egypt By Train (Spark Media) and Lost Temples Of Cambodia (Bright Button Productions).

One positive, says Heaney, is the market’s embracing of innovative funding models: “Everyone is now willing to do a co-production, and that spans the widest possible range of definitions.”

EXPANDING THE POLL

This year’s Distributors Survey included a sub-set of polls asking respondents to nominate their peers in categories including leading scripted and unscripted distributor and best small/medium-sized distributor outside of the ‘big six’. The results provide a snapshot who else is in the UK sales houses’ thinking.

In the small/medium category, there is a three-way tie between AMR, Hat Trick International and Passion Distribution. While AMR is also an established presence in the main poll, distributors noted HTI’s “fantastic output in both scripted and non-scripted content”.

Passion, tied with All3MI and Banijay Rights for best unscripted distributor, is praised for “always having a diverse and interesting slate in the factual area, which goes from strength to strength each year”.

All3MI, a clear favourite across the board, is just ahead of Banijay for best scripted distributor.

Distributors make hay despite challenges ahead

- 1

- 2

- 3

Currently reading

Currently readingAll3Media holds on to top spot in Peer Poll

- 4

No comments yet