UK drama commissions in 2024 were up almost a third year on year, according to figures from Broadcast’s parent company GlobalData

Last year saw an uptick in the number of UK drama commissions - that’s according to analysts Costanza Barrai and Jemma Preston, who examined data from the commissioning database of GlobalData’s Media Intelligence Centre.

The newly launched Media Intelligence Centre offers insights into the programme trends across 20 of the world’s biggest entertainment markets as well as the strategy of commissioners and key decision makers. The tool also allows users to drill down on different areas of the TV and entertainment sector including sizing the SVoD, Pay TV, AVoD and TVoD markets, understand consumer behaviour from a 30-country panel, and will unlock schedule and streaming catalogue details at a global scale.

The headline stats:

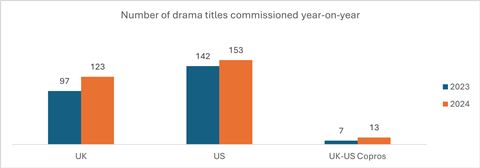

- In 2024, UK commissioners greenlit 136 new dramas compared to 104 in 2023, with the BBC alone adding 50 new dramas. This is an increase of 31%.

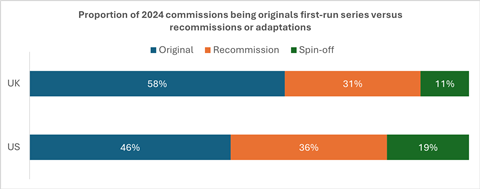

- Original first-time commissions made up 58% of the drama slate in the UK, a bigger proportion than recorded in the US (46%)

- As the American political and economic landscape faces uncertainty, European markets can offer many opportunities to British commissioners and producers for co-creation and co-funding – the BBC recently tied with Germany’s ZDF for a scripted co-commissioning pact.

- Demand remains high for series built around known IP, either from books or other source material

- There’s more experimentation to come in windowing conversations when collaborating with partners, particularly streamers

- Marrying up trending subgenres with familiar IP can offer opportunity to re-tell stories with a new feel

Looking up: more commissions and opening opportunities for foreign partnerships

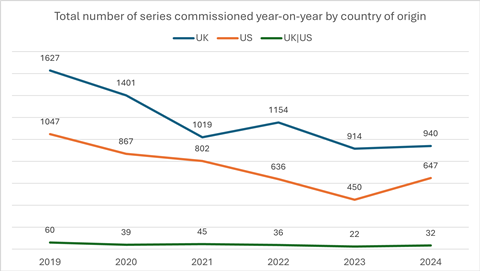

In 2024, there was a 17% uplift in TV commissioning in both the UK and the US, mainly driven by US orders, which increased from 450 to 647.

The number of collaboration projects between UK and US players also saw growth from 2023 to match similar levels recorded in 2022.

However, while there are growing concerns about the US being a reliable partner for the future, the European market appears to be in a healthy condition. At the recent Broadcast Summit, Richard Life from Cineflix Rights advised British creators to look at European, Australian and Canadian markets for coproduction opportunities, as these partnerships can unlock novel ideas and creativity on top of the obvious benefit of sharing risk and cost.

He cited Leonard Cohen So Long, Marianne a Norwegian, Canadian, German and Greek project later sold to ITVX through Cineflix.

UK drama commissions on the rise

UK drama, including co-productions, saw a 31% increase year-on-year, recording a total of 136 new series. The BBC leads in drama, and records higher growth than any other UK broadcaster: 50 new programmes added in 2024 alone, a 35% increase year on year.

Next comes ITV, which commissioned 14 dramas, a significant gap between the two main public service broadcasters for drama. ITV’s orders have also declined from years prior, whereas Channel 5 grew went from nine to 12 commissions.

13 out of the total of 32 UK-US coproductions greenlit in 2024 were drama series, allowing for creative new ideas to appear on screens, as well as being a clear sign of how important co-funding is in the scripted space specifically.

Examples include BBC1 working with HBO on the fourth series of Industry – which tells the story of graduate investment bankers in London – and Sky Atlantic’s comic thriller Sweetpea, which will return to US cable network Starz for a second season.

Compared to 2023, the BBC worked with more different producers, with the number of productions involving in-house BBC Studios companies decreasing from nine to four year-on-year. BBC1 employed Sister for upcoming coming-of-age drama The Dream Lands and its legal drama spin-off special The Split: Barcelona.

Clapperboard, part of the iZen group, was the label involved in the highest number of dramas in 2024, preparing seven titles exclusively for Channel 5 and Paramount+, including upcoming series Catch You Later and co-production with Cuba Pictures for The Rumour.

Elsewhere, Sony Pictures Television-owned Bad Wolf and Warner Bros. International TV Production label Wall to Wall both increased their drama output in 2024 compared to the year prior, with the former’s upcoming slate including the second season of Red Eye for ITV1 and Doctor Who companion series The War Between the Land and the Sea for BBC1 and Disney+, whilst Wall to Wall won four series of Waterloo Road for BBC1.

Different models of collaboration can lower the risk of bringing fresh ideas to screens

Data also suggests that commissioners in the UK are happy to take on some risk and experiment with new ideas as over half (58%) of dramas in 2024 were original, first-time commissions. This was only 38% for US drama, which instead relies more heavily on re-commissions, spin-offs or remakes.

This year, we saw PSBs particularly experimenting with new original ideas, with examples including ITV greenlit six-part thriller Cold Water as well respective espionage and crime series Secret Service and Saviour. BBC1 commissioned first-run originals across a range of subgenres including romance series Babies and thriller The Listeners.

Global streamers looked at the UK extensively for scripted output, greenlighting 41 dramas here, a big increase from the 25 shows recorded the previous year. Unsurprisingly, the biggest player here is Netflix, followed by Apple TV+ and Prime Video. Netflix diversified its drama suppliers, commissioning Fool Me Once outfit Quay Street Productions again for Missing You and Run Away, while bringing together international partners for the second series of 3 Body Problem – made by Plan B Entertainment (US) and Primitive Streak (UK) – and Italian original The Leopard (Moonage Pictures and Indiana Productions Italy).

Original ideas included Netflix’s highly acclaimed Adolescence and Amazon’s psychological thriller series Fear, whereas Apple’s UK drama slate, following a quiet 2023, focused more on recommissioning, including season two of Hijack, made by 60Forty Films, Green Door Pictures and Idiotlamp Productions, and season six of See-Saw Films’ Slow Horses.

In 2024, we recorded five streamer-UK channel projects, including A Good Girl’s Guide To Murder, commissioned by BBC3 and Netflix. In a climate where we see slow signs of recovery in scripted content, the UK is still behind other countries in experimenting with windowing rights with streamers.

Discussed at this year’s Indie Summit was the notion that streamers and YouTube shouldn’t be viewed solely as competition, but rather as channels that can open up new ways of collaboration and create win-win situations. Samuel Kissous from Pernel Media points at France as an example of where broadcasters have successfully allowed first windows to Netflix.

Genre trends: re-imagining stories to tap into existing audiences: from books to games and social media creators

In the UK, there is an uptick in the proportion of book adaptations, which is the top tagged keyword (book-adaptations) for programmes across both 2023 and 2024. Though picking up more original first-run series shows signs of commissioners experimenting more, adapting IP remains an appealing way to reduce risk and spark the curiosity and engagement of existing audiences.

Global streamers have been very active in this space in recent years and now IP adaptations currently make up 50% of drama commissions (vs 42% in 2023). In both scripted and unscripted, we expect to see more growth in franchises and IP coming from other source material, particularly digital-first assets such as films, video games and most importantly social media formats such as dramas like The Witcher and Fallout, and gameshows like Beast Games and Inside.

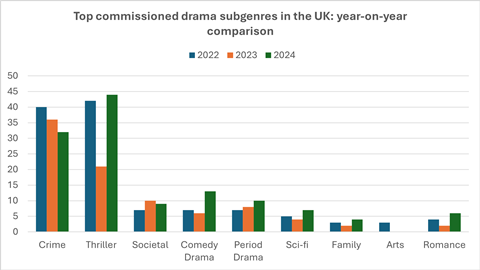

Crime and thrillers continue to dominate, with a total of 76 commissions, of which one third were recommissions of existing series. BBC1, Netflix and ITV1 lead in these subgenres, and partnerships of note include that of BBC1 with Prime Video for series 2 and 3 of The Night Manager, ITV with PBS for Professor T series 4, and Peacock and Sky for The Day of the Jackal series 2.

Though on a much smaller scale, emerging themes in scripted commissioning include period dramas, romance and relationships, and Britain-focused stories. Period dramas and romance have been of interest also outside the UK, as we’ve seen Netflix produce The Leopard based on the Italian historical novel, or royal family drama Ena by RTVE Spain presented at Mipcom 2024.

Bad Wolf’s Dope Girls

In the UK, the BBC ordered Dope Girls, adapted from the novel set in the 1920s, Channel 4 picked up an adaptation of the 1979 novel A Woman of Substance, and ITV1 ordered Tudor period drama Majesty. Recently, there’s been opportunity to be found in marrying up book adaptations and historical eras to revive older stories and reimagine classic genres.

This analysis is an example of the type of content that will be created by GlobalData’s forthcoming Media Intelligence Centre, which gives access to the industry’s data, analytics, and insights. Stay informed by joining our mailing list.

![]()

No comments yet