From splashy drama sales and new models to riskier adaptations, is the scripted storm passing?

It has been quite the ride for those in the scripted game over the past couple of years.

A trifecta of rising costs, lower budgets and reduced demand have hit producers in almost all countries, save perhaps Spain.

More recently, risk aversion has propelled a flight for safety, which has seen bolder projects shelved and the words ‘broad appeal’ uttered endlessly by commissioners at international conferences and markets.

But six deals this week point to a (potentially) improving picture as scripted evolves.

Back to basics

Let’s start off with what looks on the face of it to be the most traditional of deals, Mediawan’s sale of its sprawling Italy-produced scripted series, The Count of Monte Cristo.

Production of the 8 x 52-minute series has been kept wholly within the Mediawan empire, with Palomar and DEMD onboard, and Mediawan Rights selling outside of Italy and Spain, where Rai and France Televisions are respective commissioners.

But delve a little deeper, and this is a show that has been fuelled by the much-talked about opportunity of private equity financing, namely Paris-based firm Entourage Ventures, with which Mediawan struck a co-development deal a few years back.

And then look at some of the buyers: sure, there are ongoing fears over PBS’s financing in the face of Donald Trump’s threats to US public media, but securing a deal with its Masterpiece strand is no mean feat, even if Stateside sale prices are likely subdued with PBS and BritBox seemingly the only US-based operations acquiring internationally at present.

The emergence of UKTV is another pause-worthy development: the BBC Studios-owned, UK-focused streaming and channel operator has been enjoying a growth spurt over recent years and pick-ups of splashy shows such as Monte Cristo, and commissions like period tentpole Outrageous, suggest deeper, underlying confidence.

Outside of the US and UK, Mediawan also found success in Spain with TVE and across the Nordics, deals that are perhaps to be expected – but look at CEE, where Poland’s TVP, TV2 in Hungary and Ceska TV also dipped into their coffers, reflecting the show’s “global resonance”, as sales chief Valérie Vleeschhouwer put it.

Risk and returns

While we’re looking at CEE deals, how about a slightly different case of a scripted opportunity that turned into a success this week.

While the adaptation of Alexandre Dumas’ masterpiece IP might not be classed as the riskiest of projects – at least from a creative point of view – the embrace of a decade-old, youth-skewing, digital scripted format by a public broadcaster in linear-loving Croatia was.

Skam was born in Norway and has gone on to travel the world via Beta Film – remember Facebook Watch’s version? – but the decision by Croatia’s HRT1 to adapt the format was intriguing.

Yet it has worked: known locally as Sram, the first series amassed more than 64 million views online and the show’s various social media platforms have attracted more than 160,000 followers (Croatian population: 3.8 million).

A second series is now in the works and set to premiere on 25 April.

Listening in

While adapting a scripted format is one way commissioners are looking to mitigate risk (and cost), over on the other side of the Atlantic a related strategy was playing out.

Eschewing the traditional drama format route, MGM+ and Sony Pictures Television instead punted for a podcast adaptation of 2022 hit American Hostage from Criminal Content.

It no doubt helped that Mad Men and Landman star Jon Hamm voiced part of the audio on the pod – because he is also set to star and exec produce on the TV version, which may have swayed MGM+’s greenlight thinking.

The show, which also has a working title of American Hostage, is from co-creator and executive producers Shawn Ryan (The Night Agent) and Eileen Myers (Mad Dogs).

It tells a complex, character-focused story set in the 1970s about an Indianapolis radio reporter who is thrust into the middle of a life-or-death crisis when a hostage-taker demands to be interviewed on his show.

And while the show’s premise doesn’t scream ‘broad appeal’, it does reflect comments from SPT’s studios chief Katherine Pope last year, in which she pointed to the power of being unaffiliated and thus able to develop riskier ideas to take to buyers who might not have realised they actually want them.

Production starts in Canada this autumn and SPT will distribute internationally.

Reset time?

It is not just adaptations of venerated podcasts that are failing to abide by the ‘broad appeal’ rule either.

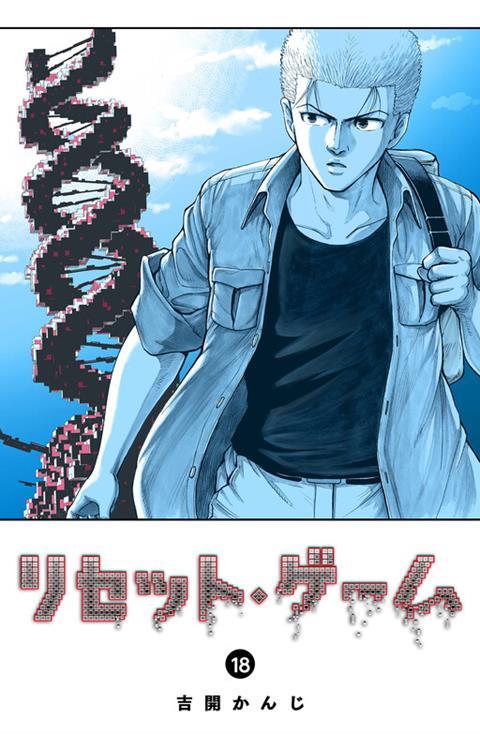

Lionsgate-backed Globalgate Entertainment revealed this week it is partnering with Ascendant Fox, the acclaimed UK indie behind Boiling Point, on an English-language adaptation of hit Japanese manga title, Reset Game.

Tehran producer Simon Allen is attached to write the pilot and will serve as showrunner for the adaptation, which is being produced in association with Manga distributor Comisma.

Allen’s credits are myriad: he created the BBC2 adaptation of Terry Pratchett’s fantasy police procedural The Watch and has written and exec produced Sky’s Das Boot and Netflix’s critically acclaimed film Choose or Die.

Reset Game, meanwhile, might sound familiar to those enduring day-to-day life at an embattled US media corporation, with the story tracking a group of multinational captives who enter a brutal survival maze known only as The Tower, a sentient, shifting structure where every floor unlocks new horrors and only collaboration can lead to salvation.

Whether the adaptation makes it beyond development remains to be seen, but its existence again suggests a warming up of the commissioning environment.

Finding your form

Several deals this week also point to a more open mindset when it comes to those commissioning, not least in the lengths and types of shows being picked up.

Take nascent Israeli content streamer Izzy, which this week hired former Disney exec David Levine to expand into daily dramas. Netflix has been pushing into this genre in Europe over recent years, and Izzy is now following suit, with Levine spearheading the effort.

Israeli series Dumb launches on the streamer later this month and it will be followed by a slate of teen dramas licensed from Paramount’s Ananey Studios, whose slate includes Rising, The Hood, Sky, Greenhouse Academy and Spell Keepers.

We’re also seeing experimentation elsewhere, including the first movements into single dramas from Paramount-owned 5 in the UK.

It unveiled a raft of shows last month as part of its Lawless Britain season, with The Trial – exploring what happens if parents are held legally responsible for the crimes of their children – set to be on the first wave of shows.

In an exclusive interview with Broadcast in February, chief content officer Ben Frow revealed 5 is playing around with its scripted commissioning. Drama commissioner Paul Testar also pointed to the series this week, saying it marks “an exciting new direction” for the company, ”embracing one-off, high-impact storytelling that sparks conversation.”

And meanwhile…

None of the above is to ignore the more run-of-the-mill news emerging over the past week, including Netflix unveiling adaptions of Edith Wharton’s The Age of Innocence and Jhumpa Lahiri’s short novel collection, Unaccustomed Earth.

Apple TV+ also greenlit a new Will Sharpe-comedy from Sister and an as-yet untitled drama from Bad Wolf that is based on Metropolis, a novel from Philip Kerr’s globally bestselling book series Berlin Noir.

The recipe for this one includes Conclave writer and executive producer Peter Straughan and Tom Hanks’ shingle Playtone, underlining that established talent still rules at Apple.

But more broadly in the world of scripted, an evolution of sorts seems to be at play as the industry grapples with its reality.

We’ve seen premium dramas bagging country-by-country pick-ups, long-running scripted formats finding growth in new markets, riskier subject matter (albeit based on existing IP) being explored – even commissioned – and niche streamers/broadcasters moving into new types of shows.

For a genre that has been in the doldrums for the past 18 months, such a reading of events could just point to a brighter, more manageable future.

No comments yet