Screen summarises 10 findings from the European Audiovisual Observatory’s Key Trends 2025 report

TV drama production is falling in Europe, while gender inequality remains entrenched and growth in the audiovisual industry is sluggish.

These are just some of the trends shaping the European TV and film industry that are highlighted in a new report from the European Audiovisual Observatory (EAO), published at Series Mania in March.

Broadcast International summarises 10 findings from the EAO Key Trends 2025 report below:

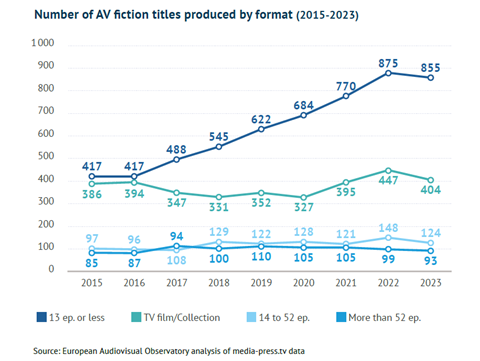

Downturn in TV production

TV fiction production in Europe has reached a turning point. After a brief post-pandemic return to growth, the production and release of original TV fiction is declining; there was a 6% drop in the number of fiction titles produced in 2023. Over half of fiction titles produced in Europe in 2023 were commissioned by public service broadcasters (55%), followed by private broadcasters (31%) and global streamers (14%).

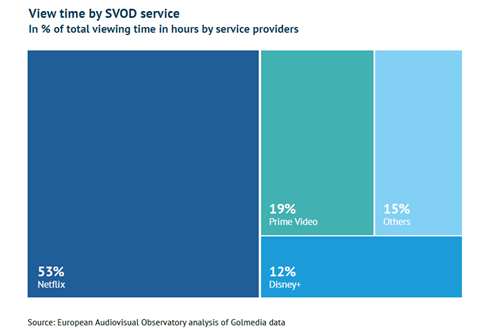

SVoD concentration

Between them, Netflix, Prime Video and Disney+ account for 85% of SVoD viewing time in Europe. Overall, European works account for 30% of SVoD viewing time, with a slightly higher share for films than for TV series. European films appear to be underconsumed, with a 33% share of viewing time despite them making up 43% of catalogues.

Limited growth

The AV market grew by 4.3% in the EU in 2023; but with inflation at 6.4%, the market actually shrank. Most of the traditional segments of the audiovisual sector are stagnating or declining in real terms: TV advertising, public funding by public service broadcasters, physical home video and box office revenues. The limited growth of the AV market is almost entirely due to two market segments: subscription and transactional video on demand.

Content spend

Spending on European original content, excluding news and sports rights, reached a new high of €22bn (£18.4bn) in 2023. Spend by broadcasting groups was stable, meaning it decreased in real terms. On the other hand, global streamers increased their investments by 23%. Overall, global streamers accounted for 26% of audiovisual investments in European original content. The UK (29%) and Germany (20%) between them accounted for almost half of all broadcaster and streamer investments in original European content. France (14%), Spain (9%) and Italy (7%) were also in the top five. Smaller countries struggle to capture a significant share of streamer investments.

TV vs film

There were 31,000 writers and directors of films and TV/SVoD fiction between 2015-2022. However, the growth in production of European fiction series has seen writers and directors increasingly migrating to TV from film over the period. 60% of writing or directing assignments now go to TV. Once working in television, writers and directors tend to stay there as there are more work opportunities.

Gender inequality

The share of female professionals across all job categories stands at 24% in film and 28% in television. The lowest share of female professionals is found for cinematographers and for composers. The share of women film directors stood at 25%, while female editors and producers both represented a 31% share of the workforce.

Adaptations

Streamers are keener on adaptations than traditional broadcasters. Some 12% of all film and TV fiction produced in Europe between 2015-22 were adaptations – the equivalent of 1,189 film and TV series. But the share was highest for streamers at 19%, compared to 13% for private and 11% for public broadcasters. The UK has the highest share of adaptations – 26% of all films and TV series are adaptations in the UK, followed by France (18%), Sweden (17%), Spain (16%) and Italy (15%).

US leadership

US group Comcast, parent company of NBCUniversal and Sky, was the number one audiovisual group in Europe with €15.3bn of revenues in 2023. This was followed by Disney (€8.9bn) and Netflix (€8.1bn). Six of the top 10 AV players in Europe were represented by European groups, led by Germany’s ARD and RTL, followed by the BBC, Canal+, ITV and ProSiebenSat.1. From the US, Warner Bros Discovery was also in the top 10.

Film production grows

The number of feature films produced in Europe has returned to pre-pandemic levels and is growing. In 2023, an estimated 2,358 fiction and documentary feature films were produced across the continent – a peak only surpassed by the record 2,375 films produced in 2019. Italy led Europe in production volume with 354 films, followed by Spain with 306. France and the UK each produced an estimated 236 features.

Film financing

Direct public funding is the single most important financing source for European theatrical fiction films, accounting for 26% of total financing. Production incentives are the second most important source (21%), followed by producer investments (18%) and broadcaster investments (17%). The share of pre-sales continued to decline to 13% of total financing. The median budget for a live-action film stood at €2.12m (£1.84m) in 2021.

No comments yet